The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about the Federal Reserve's decision on whether to raise the federal funds rate. Other topics in this edition include falling oil and gas prices, the European Union's response to an influx of Syrian refugees, and the U.S.'s lagging efforts in exploration of the Arctic Ocean.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Summer Edition: Volume 2

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about the effectiveness and consequences of a cigarette tax. Other topics in this edition include the National Debt, African economic growth, and the potential privatization of the Pennsylvania state liquor system.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Summer Edition: Volume 1

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee. This is the first edition of the Optimal Bundle jointly overseen by new Print Education coordinator Steve Leonard and Vice President of Education Joe Kearns.This edition of the Optimal Bundle features an op-ed about an application of perfect competition and oligopolistic market structures to the 2016 U.S. Presidential primary elections. Other topics in this edition include the consolidation of the health insurance market, the AIG civil trial, and the expiration of the Export-Import Bank's charter.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Special Report on the Millennials

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee. It centers on a single economic topic covered in-depth from multiple perspectives.This edition of the Optimal Bundle features the Millennials, in an attempt to determine whether or not the generation of people born between the 1980s and early 2000s will have a better economic future than their parents.This is an online version of the print edition of the Optimal Bundle.

The Life Cycle Hypothesis and the Puzzle of the Philadelphia 76ers

By Joe Kearns

It would be a massive understatement to claim that Philadelphia 76ers general manager Sam Hinkie defies the conventional wisdom of the NBA. It is much less recognized that Hinkie defies the conventional wisdom of macroeconomic theory as well.

Hinkie’s amassment of draft picks at the expense of short-term success runs contrary to the Life Cycle Hypothesis developed by economist Franco Modigliani. Modigliani's research suggested that individuals plan their consumption and savings behavior over their lifetimes. Specifically, individuals smooth consumption over the course of their lifetimes, borrowing when their income is low and saving when it is high.

To use this analogy properly, I would say Hinkie’s tendency to trade veteran players for draft picks is analogous to saving, sacrificing short-term utility in an attempt to provide a positive net utility in the long run. In other words, this is the opposite approach the Life Cycle Hypothesis suggests he should take.The best contrast with the Sixers is the Cleveland Cavaliers. The Cavaliers had the first overall pick of the 2014 NBA Draft and selected Andrew Wiggins, only to trade him and Anthony Bennett to the Minnesota Timberwolves for 3-time All Star Kevin Love as part of a 3-team deal (incidentally, the Sixers were the third team and I will delve into that angle soon). It should be noted that the Cavaliers were in an unusual situation, having signed 4-time NBA MVP and Ohio native LeBron James. Still, Cleveland’s resources were heavily allocated towards the short-run, at least relative to the Sixers.

Meanwhile, in the same trade that sent Love to the Cavaliers, the Sixers received a first round pick from Cleveland. Trades like this have been the norm for the Hinkie-era Sixers. For example, in 2013, the Sixers traded All-Star point guard Jrue Holliday and their second round pick for the draft rights to First Team All American center Nerlens Noel and a 2014 first round pick.Hinkie’s second draft actually geared the Sixers further toward the long-run at the expense of the short-run than his first. In 2014, the Sixers selected Big 12 defensive player of the year Joel Embiid with the third overall pick. The remarkable part about Embiid’s selection is that it was known he would likely miss the entire 2014-15 season due to a foot injury. Thus, the Sixers gained no short-run benefit from this selection.

Then, the Sixers traded for the draft rights of Croatian power forward Dario Saric, who is under contract for Andalou Efes S.K. of the Turkish Basketball League. Saric said he would play at least one more season in Turkey before joining the Sixers. The Sixers yet again resist the proverbial marshmallow.The 2014-15 regular season saw the Sixers make the most curious display of delayed gratification yet. They dealt point guard Michael Carter-Williams, the team’s first round draft choice in 2013, for a future first round pick. Carter-Williams earned NBA Rookie of the Year honors, but proceeded to struggle with a low field goal percentage of .380. Still, it is curious that the Sixers essentially gave up on his potential so quickly.

There is value in acquiring future assets to make the team more potent in the future, but risks are immense as well. The biggest risk is that the Sixers have removed themselves almost completely from one avenue of player acquisition by becoming the least attractive destination for free agents. Why would a free agent possibly want to come to a team that is structured to lose often for the foreseeable future? Additionally, the players the Sixers are selecting might decide they want to leave the team when they have the chance as well, unhappy with the track record of losing. Intentionally tanking a season for an early pick one season is an accepted, albeit unspoken, practice in the NBA, but to do so two or more seasons is unprecedented. Uncertainty is rampant.In the two seasons since Hinkie was hired in 2013 along with head coach Brett Brown, the Sixers have earned a record of 37-127. This would normally be perceived as an unequivocal catastrophe for an NBA team. But, in fact, earning such a poor record to this point is precisely the plan Hinkie has prescribed for the team. Hinkie has fully resisted the temptation of eating the marshmallow. The question is this: Will the marshmallow even exist by the time he is ready to eat it?

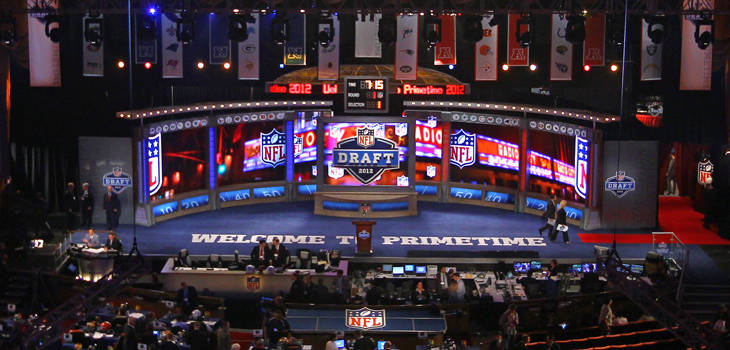

The NFL Draft's Keynesian Beauty Contest: Enter Marcus Mariota

By Joe Kearns

Trading up in the NFL Draft for a premier player generally comes at a steep price because of the perception of an equally steep opportunity cost. Let’s discuss a few examples:

- In 1999, the New Orleans Saints traded all six of their draft picks to the Washington Redskins. They moved from the 12th overall pick to the 5th overall pick, so they could select Heisman Trophy winning running back Ricky Williams.

- In 2011, the Atlanta Falcons traded their first round (27th overall), second round, and fourth round picks from the 2011 draft, as well as their 2012 first and fourth round picks to take the sixth overall pick from the Cleveland Browns. They selected future Pro Bowl receiver Julio Jones.

- In 2012, the Redskins traded their 2012 first round (sixth overall) and second round picks, along with their 2013 and 2014 first round picks to take the second overall pick from the St. Louis Rams. They selected Heisman Trophy winning quarterback Robert Griffin III.

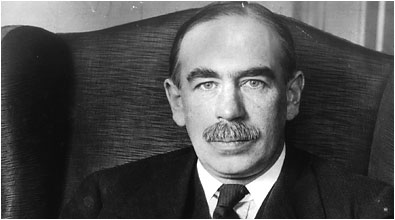

All of these teams would have preferred to have avoided trading up, and simply taken the player they coveted with their own first round pick. However, high expectations that at least one competitor would use their own earlier pick on a player increased the price the team was willing to pay.Economist John Maynard Keynes described a similar phenomenon in his seminal work, General Theory of Employment, Interest, and Money. He analogized price fluctuations in the stock market to a beauty contest, in which the contestants are judged not on the opinion of each individual judge, but what the judge perceives to be the predominant opinion of his peers: “It is not a case of choosing those [faces] that, to the best of one's judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.” (Keynes, General Theory of Employment, Interest and Money, 1936).

All of these teams would have preferred to have avoided trading up, and simply taken the player they coveted with their own first round pick. However, high expectations that at least one competitor would use their own earlier pick on a player increased the price the team was willing to pay.Economist John Maynard Keynes described a similar phenomenon in his seminal work, General Theory of Employment, Interest, and Money. He analogized price fluctuations in the stock market to a beauty contest, in which the contestants are judged not on the opinion of each individual judge, but what the judge perceives to be the predominant opinion of his peers: “It is not a case of choosing those [faces] that, to the best of one's judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.” (Keynes, General Theory of Employment, Interest and Money, 1936).

The slew of media rumors this offseason point to Oregon quarterback Marcus Mariota as this year’s proverbial beauty pageant contestant. Not only is Mariota the most recent Heisman Trophy winner, but quarterbacks generally get valuated much higher than the average prospect due to the perception of higher value attached to that position.This hypothesis is contingent on the Tampa Bay Buccaneers using the first overall pick on Florida State quarterback and 2013 Heisman winner Jameis Winston. Assuming Tampa Bay selects Winston, the Tennessee Titans (second overall pick) are the team all of the other front offices have their eyes on. But why should we not assume the Titans would just draft Mariota themselves?

First, their poker-playing abilities have been suspect. In February, Titans general manager Ruston Webster downplayed the notion that they would pursue a quarterback with the second overall pick and talked up incumbent starter Zach Mettenberger. Then, Titans head coach Ken Whisenhunt shifted gears in March by heaping praise on Mariota. It made absolutely no sense for the Titans to initially downplay the notion that they might want a quarterback early. Because of that, the perceived value of the second overall pick fell. Whisenhunt might have been trying to undo some of the damage to the value of his team’s asset caused by Webster’s comments.Second, the Titans have the potential to create a deep market among NFL teams interested in acquiring Mariota. The more teams show interest in trading up, the higher the return the Titans can earn. Basic microeconomics dictates that the higher the demand goes, the higher the price will climb.The most visible rumor is that the San Diego Chargers will offer the seventeenth overall pick and top tier veteran quarterback Philip Rivers to the Titans for the second overall pick, which they will use to select Mariota. While this rumor has some credibility with Rivers refusing to sign a contract extension, game theory suggests the Titans have every reason to spread these rumors to artificially inflate the value of their pick.Who might the Titans be trying to draw in? Look first at teams with a steep supply of desirable assets. Perhaps the Cleveland Browns, who have 35 year old Josh McCown and Johnny Manziel—coming off an underwhelming rookie season—as their top two quarterbacks. Not to mention the Browns have two first round picks to offer. Or maybe it’s the New Orleans Saints who have 36 year old Drew Brees and two first round picks of their own.The New York Jets are a strong possibility to select Mariota as well, either by trading up or staying put at the sixth overall pick. Jets owner Woody Johnson has entered the poker game and, in my opinion, made an obvious bluff: “[Incumbent Jets starting quarterback] Geno [Smith] is probably way ahead of him at this point, believe it or not, whether you guys [reporters] have skepticism of that or not. Certainly, [Mariota's] college career was good.” Consider me skeptical when you claim a player who lost his starting job to a 34 year old Michael Vick is superior to the defending Heisman Trophy winner.There are plenty of other teams including the Washington Redskins, Chicago Bears, New York Giants, St. Louis Rams, Houston Texans, and Kansas City Chiefs that could look at Mariota as a valuable asset.But the most interesting wildcard of all in this Keynesian beauty contest is the Philadelphia Eagles. Prior to coming to Philadelphia in 2013, Eagles head coach Chip Kelly was Mariota’s head coach at Oregon. Kelly helped Mariota record impressive statistics as a freshman in 2012 (2677 passing yards, 32 touchdowns, 6 interceptions). Kelly is arguably the biggest reason why Mariota’s expected draft value could inflate.

Despite this personal connection, Kelly has either given up on drafting Mariota or is playing his cards close to the chest. In March, he traded incumbent starting quarterback Nick Foles and a 2016 second round pick to the St. Louis Rams for starting quarterback Sam Bradford. Shortly after the trade, he spoke to the media unannounced at a press conference that was supposed to be for one of his players: “Let's dispel that right now. I think that stuff is crazy. You guys have been going with that stuff all along. I think Marcus is the best quarterback in the draft. We will never mortgage our future to go all the way up to get someone like that because we have too many other holes that we're going to take care of.”Also, at the press conference, he went out of his way to say another team offered him a first round pick for Bradford. Unbelievably, he said the Eagles had not looked into what it would cost to trade up for Mariota, the very quarterback Kelly just called the best in the draft. The same quarterback who executed his offensive scheme masterfully as a freshman in college. It’s perfectly reasonable to think Kelly will not pay a certain price to trade up, but it cannot be ignored that he has every incentive to reduce Mariota’s expected value to an acceptable price.A good maxim to abide by when trying to understand the economic structure of the NFL Draft comes from House’s titular protagonist: “Everybody lies.”

Venezuela Today: A Terrible Situation

By Camille Mendoza

Venezuela's future is still not bright. After President Barack Obama issued economic sanctions against seven Venezuelan individuals for their involvement in several human rights violations, Venezuelan President Nicolas Maduro took the opportunity to express his dismay in the Summit of the Americas held in Panama. President Maduro claimed these policies were "the most aggressive, unjust and poisonous step that the U.S. has ever taken against Venezuela" and pledged a campaign to collect 10 million signatures on a petition he plans deliver to Obama demanding the order be rescinded. While these sanctions were ill-timed (U.S. allies like Columbia have spoken out against the policies), perhaps it is time Venezuela focused on other, more pressing matters.

Instead of criticizing the United States for what he calls an "imperialist threat" to his country, President Maduro should be concentrating on the horrible economic situation his country is currently facing. Despite having the world's largest oil reserves, inflation in the Venezuela is the highest in the world for certain markets. Basic goods like coffee, cooking oil, and flour are almost impossible to get, as shortages increasingly impede even necessary goods from reaching people of almost all economic standings. People wait in mile-long lines for hours and hours simply to find out that the goods have either run out or are unavailable. Worst of all but completely expected, crime has soared. As many as 8 kidnappings per day are the norm in Caracas, the capital. Some last 24 hours, others may go for weeks, many end in death. What they all have in common is that they involve groups of lower-income people seeking large sums of money from the more privileged Venezuelans. The nation's economy--already struggling after years of fiscally irresponsible government spending under Chavez--deteriorated even more after oil prices dropped by half in 2014. Oil exports are 95% of the Venezuelan exchange, and the sudden devaluation has put Venezuela in a position to default on foreign debt, pushing it to the brink of failed-state status.

Even after all of the inner turmoil, Marselha Goncalves Margerin, advocacy director for Amnesty International USA, agrees it may not be in U.S. interest to speak out on Venezuela’s domestic problems. “In this case, it’s probably counterproductive,” Goncalves Margerin says. “Not because there are no [human rights] violations in the United States but because there is lack of trust in both governments and it’s probably better done by governments that trust each other.” In the Summit of the Americas, the Venezuelan economic crisis is a topic that remained untouched once again.

Sources

http://www.usnews.com/news/articles/2015/04/10/venezuela-sanctions-backfire-on-obama

The Quagmire for the Unhired

By Cole Lennon

Even the best economic news can be laden with caveats. Such was the state of the Labor Department’s April 7th announcement on the estimated number of job openings in the United States, as a positive headline was accompanied by sobering reminders that the recovery is not finished. The good news is that there are an estimated 5.9 million job openings in the United States, more than at any time since January 2001. The bad news is that increases in hirings continue to lag these increases in job openings, and the underlying reasons why are even more sobering still.The first explanation is one that appeals to some economists: a skill mismatch. The theory goes that a deficit of workers who are skilled enough to fill these newly open jobs is the problem, and economics journalist Danielle Kurtzleben speculates that it may hold for some occupations. The other explanation is the one that she and others are arguably more focused on: hesitancy in hiring.Articles in the Harvard Business Review and the New York Times confirm that an important impact of the Great Recession on the labor market is more cautious hiring, as employers reportedly spend more up-front financially and in hidden costs to attempt to find the perfect candidate. The companies that have not found the candidate they find to be perfect continue looking, and the general results is that companies miss out on filling their openings for longer periods of time than normal.This article puts that broader trend into focus, as hiring will then lag the amount of openings. Sometimes the fact that great economic news like this comes with warnings labels is not a bug. This time, given the economic scarring of the Great Recession, it is a feature.Sources:http://www.vox.com/2015/4/7/8363463/job-openings-have-come-back-since-the-recession-why-not-hiringhttps://hbr.org/2013/01/dont-hire-the-perfect-candidat/http://www.nytimes.com/2013/03/07/business/economy/despite-job-vacancies-employers-shy-away-from-hiring.html?pagewanted=all&_r=0

The Optimal Bundle Special Report on Women and the Economy

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee. It centers on a single economic topic covered in-depth from multiple perspectives.This edition of the Optimal Bundle features women and the economy, in an attempt to understand the global and domestic changes in female labor force participation, equal pay, and executive board quotas.This is an online version of the print edition of the Optimal Bundle.

Collegian Op-Ed: Why Students Should Care About Economics

Use this URL to read the column from the April 10, 2015 edition of the Daily Collegian: http://www.collegian.psu.edu/opinion/columnists/article_b603f4e8-df11-11e4-b72f-0bfdb427b0e6.html

Fame and Fortune: The YouTube Way

By Camille Mendoza

Long live the internet! What began as a hobby for most has become a career for some. By now, it is well known that many of YouTube’s video bloggers (or “vloggers”, as they are known) have become actual celebrities with devoted fan bases, event appearances, book deals, and even TV/movie gigs. YouTube, which has become an online network in which the viewer gets to control what content they’d like to watch, is now a springboard for familiar faces. Justin Bieber, Austin Mahone, and Jimmy Tatro are only a few of those who “made it”, so to speak, and now have successful careers outside of the internet. However, those who chose to remain on Youtube and make their careers from there are the new species of celebrities cropping up, and they are really coming into their own.

While they are making names for themselves, one has to wonder how it is that they are able to sustain themselves financially, i.e. how do you make money off Youtube? CBS reports that as soon as an account has enough views and followers (albeit the exact amount remains undisclosed), the account creators can then become Youtube Partners. What this means is that they can get up to 55% of the ad revenue that comes in from their posts. While, once again, it is difficult to pinpoint how much ads pay from the outside, Business Insider attempted to calculate it, and they came up with some very appealing figures.Michelle Phan, makeup guru turned lifestyle personality, potentially makes over $1 million annually with her videos alone; Smosh, a duo of sketch-comedy geniuses, are estimated to make over $5.7 million; and PewDiePie, the Swedish video gamer with over 33 million subscribers, potentially makes an annual figure of over $8 million.

These salaries are simply astonishing, and while it definitely takes talent and guts to expose oneself the way YouTubers are now famous for, it definitely explains why more and more people are turning to the internet and not casting directors for jobs in the entertainment world. Fame may be fleeting, but the internet is forever.

Sources

http://www.businessinsider.com/richest-youtube-stars-2014-3#4-smosh-17

http://www.cbsnews.com/news/how-web-stars-make-money-lots-of-it/

Op-Ed: The Fuel Behind the Rocket

By Kevin Grant McClernon

Securities markets in the United States are red-hot. The Nasdaq Composite recently hit its eerie 5,000 point mark – reminiscent of the 2000 tech bubble implosion – and the benchmark 10-year Treasury is trading below 1.9%, as of March 25th. As investors worldwide pour into domestic markets, we have to ask ourselves: are investors fueling another bubble? The answer, in my humble opinion, is no. The term bubble is fairly subjective, but it is most commonly associated with the phenomenon where asset prices rise based on large amounts of market speculation, rather than fundamental analysis. Massive speculation in the housing market led to the financial crisis in 2007. The dotcom bubble in the late 1990s and early 2000s was the quintessential bubble – some technology stocks gained nearly 1000% within days of going public. Fundamentals couldn’t support this. So what’s different about today? Since the Nasdaq bottomed out at around 1,250 in March 2009, it has jumped 284%. As of March 25, the Index stands at 4,888 -- admittedly, an absurdly high growth rate for a 5-year span. However, the difference is the fuel behind the rocket. Bubbles are a result of over-speculation, which is not necessarily the case today. Then what’s fueling today’s rise? Investors are hungry. They’ve sat patiently for years in a low-to-zero interest rate world as the global economy recovered from the financial meltdown. Select German, Japanese, Swiss, and Swedish short- and medium-term government debts are currently paying negative interest. The EU is on the brink of deflation and the ECB just embarked on a massive new stimulus round aimed at pushing bond yields down even further. Growth in most EU countries is less than 1%, China is revising its growth forecasts downward at an alarming rate, and there continues to be uncertainty in the Middle East. And that leaves us with the current star of financial markets, the United States. Growth forecasts put GDP growth around 3% for 2015 and the Fed is expected to raise rates at some point this year, making domestic securities even more enticing.The capital inflows into the US securities markets, therefore, aren’t speculative by nature. As prices rise, returns should continue to thin out. Investors will presumably keep piling into them until the returns on American securities are on par with the paltry returns elsewhere. The market may be saturated, but it doesn’t appear to be a bubble. It just begs the question: to where else should investors turn? Sourceshttp://tcrn.ch/1BLjWFU http://bv.ms/1HFOMGQhttp://cnnmon.ie/1zPuF1s http://bit.ly/1DogR4Dhttp://bit.ly/1EosY1q http://bit.ly/1EosY1qhttp://on.wsj.com/19yDqYg http://bit.ly/1xUqabZhttp://yhoo.it/1yx5ilBhttp://on.wsj.com/1wd0iQH

Op-Ed: Beware the Bursting Bubble

By Joe Kearns

No two bubbles are alike. The most famous tech bubble, the dot-com bubble of the 1990s, experienced substantially different market conditions than those existing today. The NASDAQ Stock Market reached a peak of 5,408.62 in March 2000, compared to a real value (in 2000 dollars) of about 3,600 today. The U.S. economy has grown so much since 2000 that the NASDAQ would have to hit 8,500 to reach the same position. None of these facts, however, rule out the possibility that there is another tech bubble ongoing today. Though there appears to be no widespread tech bubble across the public markets, there are numerous signs from private equity and high-end public tech companies that there is a bubble elsewhere.The current tech bubble is concentrated in specific parts of the tech industry. Across the broader tech industry, late-stage financing from private equity firms nearly tripled since 2000 and supplanted IPOs. According to Bloomberg Business, late-stage companies received two-thirds of the $59 billion of investments in U.S. tech startups in 2014. In one year, a record 62 firms were valued at more than $1 billion, a total which was nearly three times the total in 2013. Curiously, investors are willing to pay more to reap fewer benefits. Hedge funds and mutual funds are now paying between 15 and 18 times projected sales for tech companies annually, compared to 10 to 12 times five years ago. SharesPost 100 Fund investment manager Sven Weber warns that as the number of billion-dollar startups increases, so will the odds that investors will suffer huge losses.There is evidence that a correction to the tech bubble is underway. Private equity firms like Bain Capital Ventures and SharesPost that financed late-stage deals are beginning to scale down investments in expensive tech companies in favor of cheaper startups. Those firms are ahead of the curve, as tech companies like Box Inc. and Hortonworks Inc. are going public at valuations lower than their final private-funding rounds. These occurrences show what happens when irrational exuberance takes the valuation of some firms to unreasonable heights. Now is the time to take cover. The bubble is already beginning to burst.Sourceshttp://bloom.bg/1HqALOAhttp://on.mktw.net/1C3DuWihttp://tcrn.ch/1BLjWFU

Uber Going Public: Wishful Thinking

By Camille Mendoza

Uber has become a staple in every city dweller’s phone screen, and investors have taken notice. Hedge funds like Tiger Management are speculating that the personal driver service, which is valued at $41.2 billion, will be going public. Fortune writer Tom Huddleston adds fuel to the fire, on the heels of recent news that Uber’s CFO Brent Callinicos had stepped down. Huddleston argues that a more Wall Street-savvy CFO could help Uber’s transition from private to public. Given recent controversies, this idea is problematic. Governments are threatening to sue or ban the service in many cities, as they claim that unlicensed drivers should be illegal. Additionally, there have been several allegations of Uber drivers raping women in places like Delhi and Philadelphia. As Fortune writer Kevin Kelleher argues, the ongoing high-profile controversies could weigh on the company’s shares in the public market. For these reasons, going public is both unwise and unlikely. Uber should remain private until it wins these regulatory battles, or crashes while trying.Sourceshttp://for.tn/1F01b3Thttp://for.tn/19zpPzL

Avago: Conducting Themselves to Success

By Rob Gelb

Behind every new version of Apple’s iPhone is the company that provides the essential parts. The man behind the curtain is Avago, semiconductor company that focuses on both chipmaking and the 4G LTE market at a time where higher bandwidths are constantly in demand. Avago conducts business with Samsung as well, and has business ventures around the world, particularly in China. The company has had six straight quarters of accelerated sales and earnings growth, while stock prices have surged by about 105% over the past year to near record highs. Merrill Lynch tipped their hats to the company, having a price target for them at $140 a share. On a daily basis, Avago is trading over 2 million shares, which are notable for their enormous volatility. For the moment, Avago is the name to remember when looking for investment opportunities. Once the iPhone 7 (inevitably) comes out, it will be more than Apple you can thank for that.Sourceshttp://bit.ly/1xUtaFfhttp://bit.ly/1ag7Tenhttp://bit.ly/1xUtt2I

Apple: Not Far From the Tree

By Cole Lennon

New business ventures are often similar to something that came before. Apple’s recent push toward streaming and radio is no different, as the tech giant aims to release a revamped streaming service and relaunch iTunes Radio. Apple will bring in more experienced professionals to help, with prominent musician Trent Reznor redesigning the streaming service and award-winning DJ Zane Lowe assisting with iTunes Radio. Updates to these services help Apple compete for market share--not just with streaming-based companies like Spotify, but online radio sites like Pandora. Even with new main rivals, Apple’s foray into music simply builds on what they already have. Music-related business, like iTunes in January 2001 and the iPod in October 2001, is an area where Apple has a broad base of experience. Now, it is just the same song with a second verse.Sources:http://bit.ly/1G4aVj4

The Optimal Bundle Special Report on the U.S. Tech Industry

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee. It centers on a single economic topic covered in-depth from multiple perspectives.This edition of the Optimal Bundle features the U.S. Tech Industry, as the tech-heavy NASDAQ broke 5,000 for the first time since the dotcom bubble in 2000.This is an online version of the print edition of the Optimal Bundle.

Patience and the Fed: A Tale of Irrational Panic

By Joe Kearns

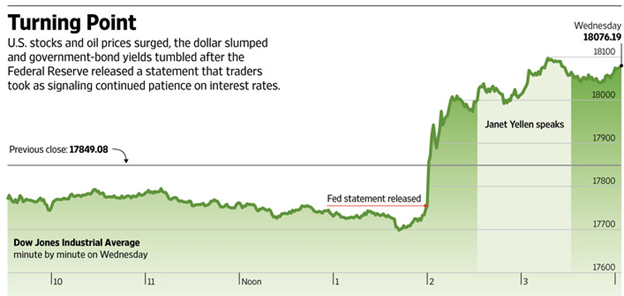

It was the best of times. It was the worst of times. Good news was bad news. Bad news was good news. By March 5, the U.S. unemployment rate had fallen to 5.5%. Though workers could rejoice at improved labor market conditions, there was one group of people that panicked upon learning this news: Wall Street. In fact, the Dow decreased by 279 points and the S&P 500 fell by 1.4% when the unemployment data was available to the public.

Surely, this was a mistake! How could improvements in the labor market and other parts of the U.S. economy possibly be bad news? The answer lies in investors’ expectations of changes in monetary policy.

“Given updated labor market conditions, we expect the probability of the Fed lifting policy rates in June is now 55%,” wrote BlackRock portfolio manager Rick Rieder.

Investors feared that good news would eventually bring an end to the Federal Reserve’s accommodative monetary policy that had been boosting the stock market. Since 2008, the Federal Reserve has held the federal funds rate between 0 and 0.25%. According to Investopedia, the federal funds rate is the “interest rate at which a depository institution lends funds maintained at the Federal Reserve to another depository institution overnight.” Keeping the federal funds rate near the zero bound has made it cheap for banks to borrow money from the Fed. In turn, consumers can borrow money from banks at low interest rates, which allows consumers to spend more and the stock market to rally. This is precisely what has happened in the U.S. economy, as the Dow Jones Industrial Average eclipsed 18,000 in December.

One word epitomized the anxiety of investors: patience. Previous FOMC Meeting Statements included a significant sentence: “Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy.” “Patient” came to an end on March 19—at least, in the sense that the FOMC Meeting Statement no longer included the word.

Yet, despite the exclusion of the word “patient,” stock prices surged. Among other comments in the statement, this one suggested the elimination of the word “patience” did not equate to a signal that the Fed would soon increase the federal funds rate target: “The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.” Fed chairwoman Janet Yellen even remarked, “Just because we removed the word ‘patient’ from the statement doesn’t mean we are going to be impatient.”

The moral of the story is this: Don’t read too much into specific words. When it comes to predicting what the Fed will do next, let economic data speak for itself.

Sources

http://www.wsj.com/articles/investors-celebrate-gentler-tone-from-fed-officials-1426720774?mod=WSJ_hp_LEFTWhatsNewsCollectionhttp://money.cnn.com/2015/03/06/investing/stocks-market-jobs-fed-rate-hike/http://www.federalreserve.gov/newsevents/press/monetary/20150318a.htmhttp://www.nytimes.com/2015/03/19/upshot/janet-yellen-isnt-going-to-raise-interest-rates-until-shes-good-and-ready.html?_r=0&abt=0002&abg=1

http://www.federalreserve.gov/newsevents/press/monetary/20150128a.htm

Op-Ed: The Half-Full Economy

By Cole Lennon

China’s economy still packs a punch. Despite this self-evident fact, The Economist writer Simon Rabinovitch predicts an era in which China’s recent slowdown will get much more unpleasant as the Chinese economy takes harsher hits to economic growth. Rabinovitch’s argument falls flat, as it neglects to note more recently aggressive monetary policy, plans for more growth-enhancing fiscal policy, and a lack of perspective on how China relates to other economies. China’s economy is not just staving off decline, it is building a better future compared to the rest of the world.The Chinese government plans to use monetary and fiscal policy to revive massive economic growth. The People’s Bank of China (PBOC) recently has been cutting interest rates and plans to cut even more to evade deflation. Inflation has risen from 0.8% in early 2015 to 1.4% now, so its plan looks promising. Fiscal policy should also provide more gains. Chinese officials recently cited $18 billion of previously unallocated spending, as well as an additional $258 billion in deficit spending next year. It is doing so to boost growth from the current rate of 7.4% and overall demand. Economist Alexander Wolf cites low demand as one of China’s biggest problems, and these measures are expected to help solve it. China’s economy is also favorable to many economies worldwide, as its 7.4% growth is higher than the average for every continent on Earth. It ranks in the top 20 among countries and only falls behind double-digit growth in much smaller economies. China’s stature still leaves room for optimism.Changes in China’s economy are ultimately a sign that economic progress is here to stay. China’s more stimulative monetary policy will ensure that growth can stay above an already high percent. Its fiscal policy will also support high growth, as it has already pumped hundreds of billions of dollars into China’s $10 trillion economy. The Chinese economy’s 7.4% growth rate is also impressive when considering the massive struggles advanced economies in Europe have faced to achieve even 1% growth. China is primed for a second round knockout.Sourceshttp://on.wsj.com/1Bpvoanhttp://reut.rs/1BwiPgxhttp://reut.rs/1BwiPgxhttp://reut.rs/1Bp5cB9http://1.usa.gov/1rqYqbfhttp://reut.rs/1EOGkCX

Op-Ed: The Half-Empty Economy

By Camille Mendoza

China's economy looked like its new cities: bright, expensive, but empty. In 2011, China became the world's leading exporter, and the largest economy, with annual GDP growth at almost 12%. Since then, growth has decelerated to 7%, causing the rest of the world to fixate on China's economic slowdown. It is easy to see that the Asian Giant's economic miracle is coming to an end by looking at the export boom and outcomes of countries that have faced banking crises in the past. The miracle is ending for China, and there is nothing it can do.The International Monetary Fund has noted that over the past 50 years, only four other countries have experienced as rapid a buildup of debt as China during the past five years. All four—Brazil, Ireland, Spain, and Sweden—faced banking crises within 3 years of their supercharged credit growth. This debt paid for China's boom and exports have sustained it. China's current surplus of exports points to billions of dollars wasted, as countries are not buying enough Chinese goods. The Wall Street Journal reported that a lone steel production company in Hebei, a province surrounding Beijing, produces twice as much crude steel as the entire U.S., and no longer needs to produce this much. China's overproduction may be its downfall.While excessive Chinese exports and consistent declines in GDP explain a bleak Chinese future, the past is also important. Harvard economists Lant Pritchett and Lawrence H. Summers argue that countries that have had long periods of abnormal growth tend to revert to around 2% growth, a meek figure in comparison to China’s current growth rate. This figure has grave implications. Economist Neil Irwin explains if growth reverts to 2%, China's GDP will be $11.2 trillion by 2033. The effects are already being felt. Wall Street Journal writer Bob Davis explained that what was once a Chinese skyline full of construction projects has become a cluster of empty apartment complexes.Optimists must have confused China's economy for a bright dawn instead of a dreary twilight brought on by high levels of debt, dangerous surplus of exports, and the already glaring signs of what China is poised to become: a ghost economy.Sourceshttp://on.wsj.com/1C8hUDuhttp://nyti.ms/1HAKphO