By Trevor Baumgartner

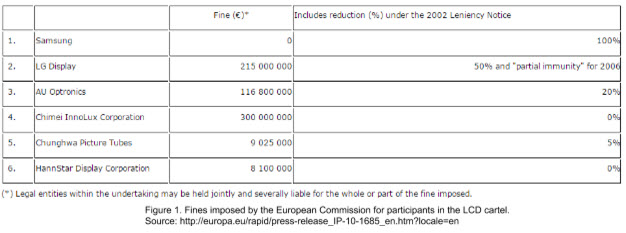

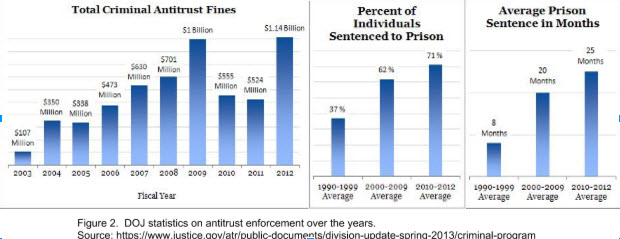

A Brief Introduction to CartelsOn September 20, 2012, the United States Department of Justice fined AU Optronics, a Taiwanese LCD manufacturer, $500 million for their participation in a price-fixing scheme--the largest single fine imposed on a firm for violating anti-competitive laws. This landmark sentencing was the result of an ongoing investigation into the LCD cartel, which has thus far resulted in $1.39 billion in criminal fines as well as jail sentences for 12 executives at the eight firms in question. Fines imposed by the European Commission for European commerce affected by the cartel are shown in Figure 1 below. Historically speaking, cartels have been present in a wide range of industries, with heavy concentration in the vitamins, auto parts, and electronics industries. Oligopolistic industries in which firms produce goods with little to no product differentiation are especially susceptible to cartel formation. If firms are unable to differentiate their product, the price of the product is driven down to a point near the marginal cost of production. Collusion then seems a natural solution for firms to ensure a favorable profit margin that would otherwise not be achievable. Cartel formation allows firms to function as a monopoly in their respective industry--giving them collective bargaining power in terms of uniformly raising prices or restricting output, or both. The large fines imposed on firms participating in cartels are a testament to the extent to which cartel activity disrupts pure market competition, and therefore warrants government enforcement. We seek to analyze the impacts and efficacy of government antitrust policy in an effort to determine what existing incentives remain for firms to collude. Leniency PolicyGovernment scrutiny of anticompetitive practices dates back to the passing of the Sherman Antitrust Act in 1890. Under the Sherman Antitrust Act, any contract or conspiracy in restraint of free trade was declared illegal, and those in violation of the act were subject to heavy fines or jail time. Public response to the act was mixed, with those in favor arguing that it protected consumer surplus by preventing monopolies from raising prices and thereby ensuring pure competition between firms. Those against argued that the act was in violation of the free market and ultimately failed in its intent to prevent unfair pricing by reducing economies of scale.On August 10, 1993, the United States Department of Justice (DOJ) adopted new legislation known as the Corporate Leniency Policy. Prior to this legislation, leniency (or partial leniency) was granted on a discretionary basis for firms that aided the DOJ in cartel investigations. Under the new guidelines, amnesty is automatically granted to the first firm to admit to cartel involvement and provide information to strengthen the DOJ’s investigation, granted that the firm meets certain conditions. Amnesty is granted provided that (1) the DOJ does not already have an ongoing investigation into the cartel, (2) the corporation seeking amnesty took prompt action to terminate cartel activity, (3) the corporation fully complies with the DOJ and provides valuable information about the cartel, (4) the confession is a corporate act and not an isolated confession, (5) the corporation makes restitution where possible, and (6) the corporation was not the ringleader of the cartel. This Amnesty Policy was the result of concerns that current antitrust legislation was not having strong enough deterrent effects. The intent of the new legislation was to destabilize cartel activity by causing distrust in existing cartels and deterring cartels from forming in industries susceptible to such activity.Following the Department of Justice’s lead, the European Commission adopted similar legislation on February 19, 2002. The conditions for amnesty under the European Commission are similar to those of the Department of Justice, with the major difference being that the European Commission will grant amnesty to the ringleader of the cartel under certain conditions.Evaluating LeniencyEffective deterrent policy should have dual effect of (1) causing formidable distrust in existing cartels and (2) raising the expected losses from indictment to a level that exceeds expected profits. With regard to creating distrust in existing cartels, corporate leniency functions by offering huge incentives to the first--and only the first--firm to come forth with information regarding cartel activity. As long as the leniency seeker meets the necessary criteria, they avoid both fines and possible jail time, while the other firms incur massive damages. Firms participating in cartels are cooperating only because price-fixing enhances their individual profits, which suggests a lack of true loyalty between firms. In other words, this winner-takes-all approach should theoretically create a sufficient level of distrust among firms in existing cartels. Scott D. Hammond of the US Department of Justice notes in a 2001 press release that, “Over the last five years, the Amnesty Program has been responsible for detecting and prosecuting more antitrust violations than all of our search warrants, consensual-monitored audio or video tapes, and cooperating informants combined. It is, unquestionably, the single greatest investigative tool available to anti-cartel enforcers. Since we expanded our Amnesty Program in 1993, there has been more than a ten-fold increase in amnesty applications.” Furthermore, the cooperation of a leniency applicant has made the process of prosecuting cartels far more efficient. The problem with evaluating the effectiveness of the corporate leniency policy lies in only being able to draw inferences based on observed cartel activity (Zhou, 2). If undetected cartels function in a more sophisticated manner, the observed sample will be misrepresentative of cartel activity as a whole.Ultimately, the more important focus of antitrust enforcement should be preventing cartels from forming in the future. Consider a bank robber that stands to gain $50,000 from robbing a bank and risks $80,000 in fines if he is caught. If the robber anticipates only a 50% chance of being caught, then his expected losses are only $40,000 when weighed against the probability of getting caught. Thus expected profit exceeds expected losses, and committing the crime remains a rational strategy for him. Economic theory suggests that the same logic holds for firms considering collusion. In this light, research suggests that cartel sanctions are not at an optimal level. Research has shown that when weighing expected profits against expected losses for a sample of 75 cartels prosecuted in the Unites States, sanctions are only 9% to 21% as high as they should be to optimally prevent cartels from forming (Connor & Lande, 428). Fines from prosecution are calculated based on the estimated increase in revenue resulting from price-fixing, so if a cartel remains confident that they will go unnoticed, then expected profits will still exceed expected losses. That being said, the Department of Justice remains confident that the increase in both fines and jail time for convicted cartels and individuals over the past few decades is an indicator that antitrust policy is moving in the right direction (see figure 2 below). It remains unclear whether the increase in the number of cases being prosecuted corresponds to less cartel activity in general, or simply means cartel activity is much larger than previously imagined. The difficulty in discerning how many cartels continue to form despite deterrent policy leaves this question unanswered.

Leniency PolicyGovernment scrutiny of anticompetitive practices dates back to the passing of the Sherman Antitrust Act in 1890. Under the Sherman Antitrust Act, any contract or conspiracy in restraint of free trade was declared illegal, and those in violation of the act were subject to heavy fines or jail time. Public response to the act was mixed, with those in favor arguing that it protected consumer surplus by preventing monopolies from raising prices and thereby ensuring pure competition between firms. Those against argued that the act was in violation of the free market and ultimately failed in its intent to prevent unfair pricing by reducing economies of scale.On August 10, 1993, the United States Department of Justice (DOJ) adopted new legislation known as the Corporate Leniency Policy. Prior to this legislation, leniency (or partial leniency) was granted on a discretionary basis for firms that aided the DOJ in cartel investigations. Under the new guidelines, amnesty is automatically granted to the first firm to admit to cartel involvement and provide information to strengthen the DOJ’s investigation, granted that the firm meets certain conditions. Amnesty is granted provided that (1) the DOJ does not already have an ongoing investigation into the cartel, (2) the corporation seeking amnesty took prompt action to terminate cartel activity, (3) the corporation fully complies with the DOJ and provides valuable information about the cartel, (4) the confession is a corporate act and not an isolated confession, (5) the corporation makes restitution where possible, and (6) the corporation was not the ringleader of the cartel. This Amnesty Policy was the result of concerns that current antitrust legislation was not having strong enough deterrent effects. The intent of the new legislation was to destabilize cartel activity by causing distrust in existing cartels and deterring cartels from forming in industries susceptible to such activity.Following the Department of Justice’s lead, the European Commission adopted similar legislation on February 19, 2002. The conditions for amnesty under the European Commission are similar to those of the Department of Justice, with the major difference being that the European Commission will grant amnesty to the ringleader of the cartel under certain conditions.Evaluating LeniencyEffective deterrent policy should have dual effect of (1) causing formidable distrust in existing cartels and (2) raising the expected losses from indictment to a level that exceeds expected profits. With regard to creating distrust in existing cartels, corporate leniency functions by offering huge incentives to the first--and only the first--firm to come forth with information regarding cartel activity. As long as the leniency seeker meets the necessary criteria, they avoid both fines and possible jail time, while the other firms incur massive damages. Firms participating in cartels are cooperating only because price-fixing enhances their individual profits, which suggests a lack of true loyalty between firms. In other words, this winner-takes-all approach should theoretically create a sufficient level of distrust among firms in existing cartels. Scott D. Hammond of the US Department of Justice notes in a 2001 press release that, “Over the last five years, the Amnesty Program has been responsible for detecting and prosecuting more antitrust violations than all of our search warrants, consensual-monitored audio or video tapes, and cooperating informants combined. It is, unquestionably, the single greatest investigative tool available to anti-cartel enforcers. Since we expanded our Amnesty Program in 1993, there has been more than a ten-fold increase in amnesty applications.” Furthermore, the cooperation of a leniency applicant has made the process of prosecuting cartels far more efficient. The problem with evaluating the effectiveness of the corporate leniency policy lies in only being able to draw inferences based on observed cartel activity (Zhou, 2). If undetected cartels function in a more sophisticated manner, the observed sample will be misrepresentative of cartel activity as a whole.Ultimately, the more important focus of antitrust enforcement should be preventing cartels from forming in the future. Consider a bank robber that stands to gain $50,000 from robbing a bank and risks $80,000 in fines if he is caught. If the robber anticipates only a 50% chance of being caught, then his expected losses are only $40,000 when weighed against the probability of getting caught. Thus expected profit exceeds expected losses, and committing the crime remains a rational strategy for him. Economic theory suggests that the same logic holds for firms considering collusion. In this light, research suggests that cartel sanctions are not at an optimal level. Research has shown that when weighing expected profits against expected losses for a sample of 75 cartels prosecuted in the Unites States, sanctions are only 9% to 21% as high as they should be to optimally prevent cartels from forming (Connor & Lande, 428). Fines from prosecution are calculated based on the estimated increase in revenue resulting from price-fixing, so if a cartel remains confident that they will go unnoticed, then expected profits will still exceed expected losses. That being said, the Department of Justice remains confident that the increase in both fines and jail time for convicted cartels and individuals over the past few decades is an indicator that antitrust policy is moving in the right direction (see figure 2 below). It remains unclear whether the increase in the number of cases being prosecuted corresponds to less cartel activity in general, or simply means cartel activity is much larger than previously imagined. The difficulty in discerning how many cartels continue to form despite deterrent policy leaves this question unanswered. In conclusion, while corporate leniency has resulted in increased prosecution, fines, and jail time, it remains unclear as to whether sanctions are at a sufficiently optimal level to deter firms in industries susceptible to cartel activity from forming cartels. The worrying statistic is the amount of cartels that have continued to form in spite of the Corporate Leniency Policy, and the number of large corporations that have participated in multiple cartels over the last few decades. Cartel recidivism is a clear indicator that incentives still exist for firms to risk heavy fines and jail time by colluding. The Corporate Leniency Policy, while certainly a beneficial tool in creating instability in cartels and aiding in prosecution, is not a panacea to worldwide anti-competitive collusion.

In conclusion, while corporate leniency has resulted in increased prosecution, fines, and jail time, it remains unclear as to whether sanctions are at a sufficiently optimal level to deter firms in industries susceptible to cartel activity from forming cartels. The worrying statistic is the amount of cartels that have continued to form in spite of the Corporate Leniency Policy, and the number of large corporations that have participated in multiple cartels over the last few decades. Cartel recidivism is a clear indicator that incentives still exist for firms to risk heavy fines and jail time by colluding. The Corporate Leniency Policy, while certainly a beneficial tool in creating instability in cartels and aiding in prosecution, is not a panacea to worldwide anti-competitive collusion.