Britain's decision to leave the European Union continues to prompt more questions than answers for global markets.October 23, 2017By Nazmus Mallick

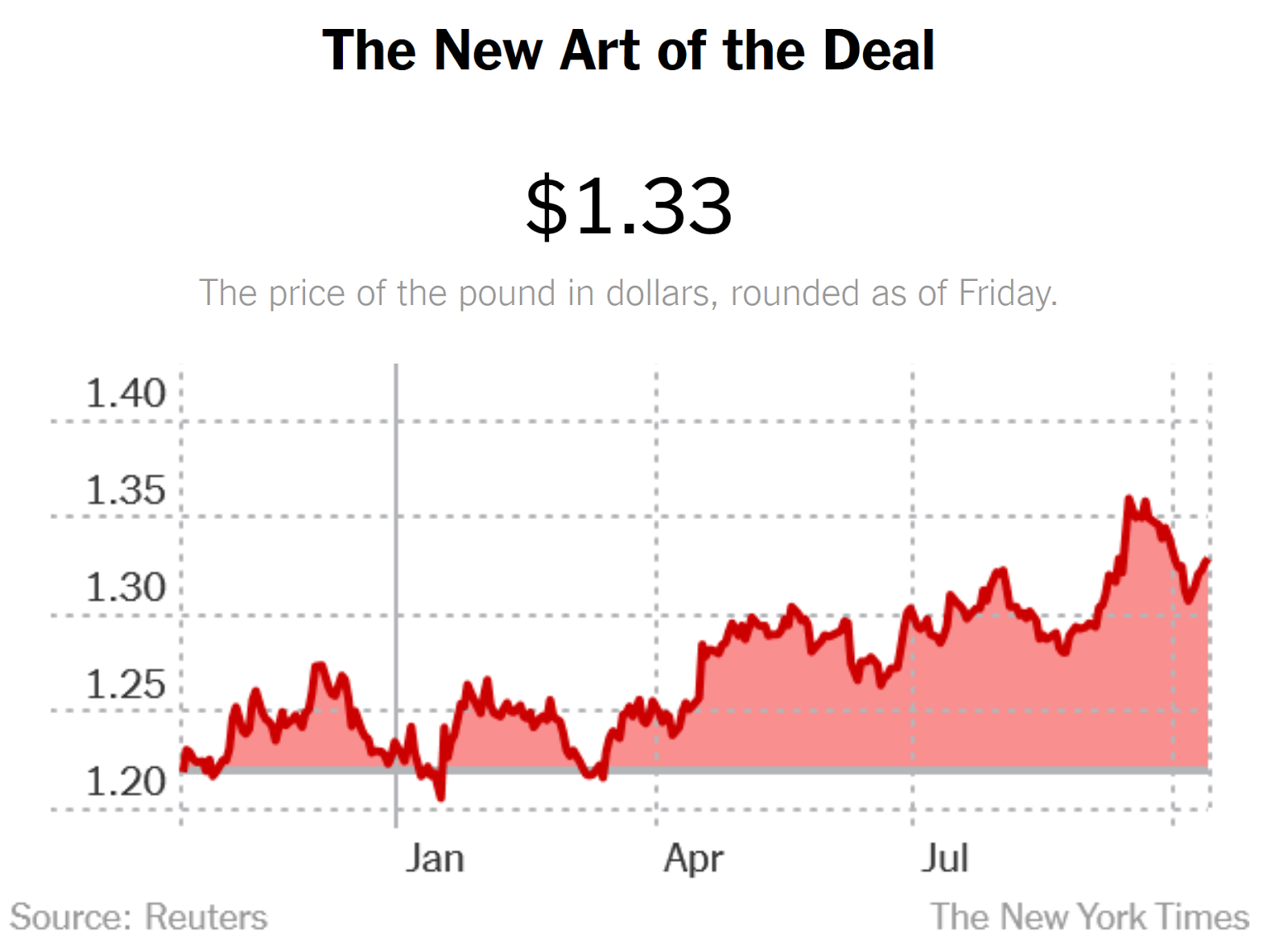

June 23, 2016 is a day redefined Britain’s relationship with the world. It has been sixteen months since the British people voted in a referendum to withdraw their country from the European Union (EU). As predicted by countless experts in academia and industry, the British economy is currently undergoing a period of uncertainty. Some of its closest trading partners, mainly United States, are carefully observing fluctuations in the British economy to see how any bilateral negotiation with a more isolated Britain will impact Anglo-American trade.On June 24 at 12:28 AM Manhattan time, the value of pound experienced a plunge against the US Dollar to its lowest level in 31 years (Figure 1).

Figure 1

According to The New York Times, the pound has dropped 10% since it was valued at $1.47 just before the decision to leave the EU. The most obvious cost of the plummeting value of the pound is the rising cost of imports. British people will no longer be able to enjoy foreign luxury goods due to rising prices and so will be deterred to make further purchases of imported goods overall. An example of this effect is seen between Unilever and a supermarket chain as the former threatened to withdraw products such as Marmite, a yeast-based spread, from the shelves. Items from Apple and Microsoft also saw increase in prices throughout the British market. A significant amount of British jobs are at stake. Once Britain is denied access to the common market, economists predict that British firms will be forced to lay off workers. Around 25% of financial companies are expected to move their operations overseas due to the cloud of uncertainty. Major investment banks like Goldman Sachs, JPMorgan, and Morgan Stanley are expected to move key operation divisions to Frankfurt, Paris or Dublin in order to hedge from any upcoming risk. This decision brought some negative signs for Americans. According to Washington Post’s Ylan Mui, more than a million people in Britain is employed in American businesses. The uncertainty that surrounds this decision is enough to jeopardize the job security of these workers.

Around 25% of financial companies are expected to move their operations overseas due to the cloud of uncertainty.

Furthermore, this article also suggested that US is the single largest investor in Britain. Many firms in US consider UK to be the main way to conduct businesses with all the 28 nations of the EU. For this reason, a departure from the EU will hurt US businesses very sharply by restricting access to these markets, reducing the revenue streams of US businesses, and forcing firms to shift their operations in the European markets in other places. The negative effects of these factors can be manifold. There will be a serious decline in exports of US products as they will become very expensive.

Caterpillar opened its first factory in Britain more than 55 years ago. It currently employs 9000 employees and operates 16 plants across Britain. Around a quarter of Caterpillar’s sales revenue come from European businesses. This poses unprecedented risk for the business community in Europe, as it will likely trigger a decline in Europe-centered sales for Caterpillar.

The Federal Reserve has been under the dilemma of raising short term benchmark interest rates. Brexit has intensified the Fed’s prospects for action. Since the Great Recession, the Fed has maintained interest rates at rock-bottom levels in an effort to spur consumption and boost aggregate demand. Brexit is cold make the waiting period for raising rates lengthier. According to Rana Foroohar of Time Magazine, the balance between costs and benefits has been deteriorating and this is very clearly seen from growing corporate debt, hesitancy of consumers to increase their consumption as they are uncertain about the strength of the recovery, etc. Since 2008, legislators were very reluctant to pass fiscal measures for an accelerated recovery. As a result, this placed increased responsibility on the central bank to steer the economy, maintaining strong growth and maintain price stability. However, rising corporate debt and shrinking economic growth associated with the crisis has put increased pressure on the banks to cope with the situation. They don’t have sufficient liquidity due to default risks and so national governments will have to take on this additional responsibility.

While uncertainty has creeped into the British economy, causing its growth to lag behind all developed countries, there are signs for calm. London is likely to remain an unrivaled center of finance due to its long-rooted institutions. International firms such as Facebook and Bloomberg LP are setting up their headquarters along the Thames at the same pace as banks reallocate divisions to other European capitals. The disruption of human capital can pose further challenges, forcing the Conservative May Government to announce actions regarding labor regulation that the Peterson Institute has criticized as being out of the “Pre-Thatcherite Labour rhetoric”. If legislators on both sides of the Atlantic can take preventive measures from any unwanted shocks, it can serve as a valuable safeguard for the economies of both, the United States and Britain.

____

Featured image: Central London. The River Thames flows south of Buckingham Palace, St. James Park, Westminster and Whitehall. Upon bending eastward at Charing Cross, it swerves through the financial districts of City of London and Canary Wharf in the distance. Credit: Jason Hawkes

ReferencesIndependent. Chu, Cox and Rodionova, (22 June, 2017). Brexit: The economic and business cost to Britain one year after the vote. Retrieved October 14th 2017, from http://www.independent.co.uk/news/business/news/brexit-latest-news-business-economic-costs-banks-one-year-vote-anniversary-eu-exit-a7802596.htmlThe Washington Post. Mui Y, (June 18, 2016). ‘Brexit’ could send shock waves across U.S. and global economy. Retrieved October 14th 2017, from https://www.washingtonpost.com/news/wonk/wp/2016/06/18/how-brexit-could-hurt-america/?utm_term=.bc6ee92a9930NurseBuddy. Retrieved October 14th 2017 from https://nursebuddy.co/blog/brexit-mean-uk-care-companies/Time. Foroohar (June 27, 2016). Why Brexit Really Is a Big Deal for the U.S. Economy. Retrieved October 14th 2017 from http://time.com/4383202/brexit-america-fallout-economy-fed/