New tax legislation poses challenges for some Americans, but enthuses and incentivizes productivity for others. January 19, 2018

Patrick Reilly, Nazmus Mallick, Avery Ryan, and Peter Scharf

________

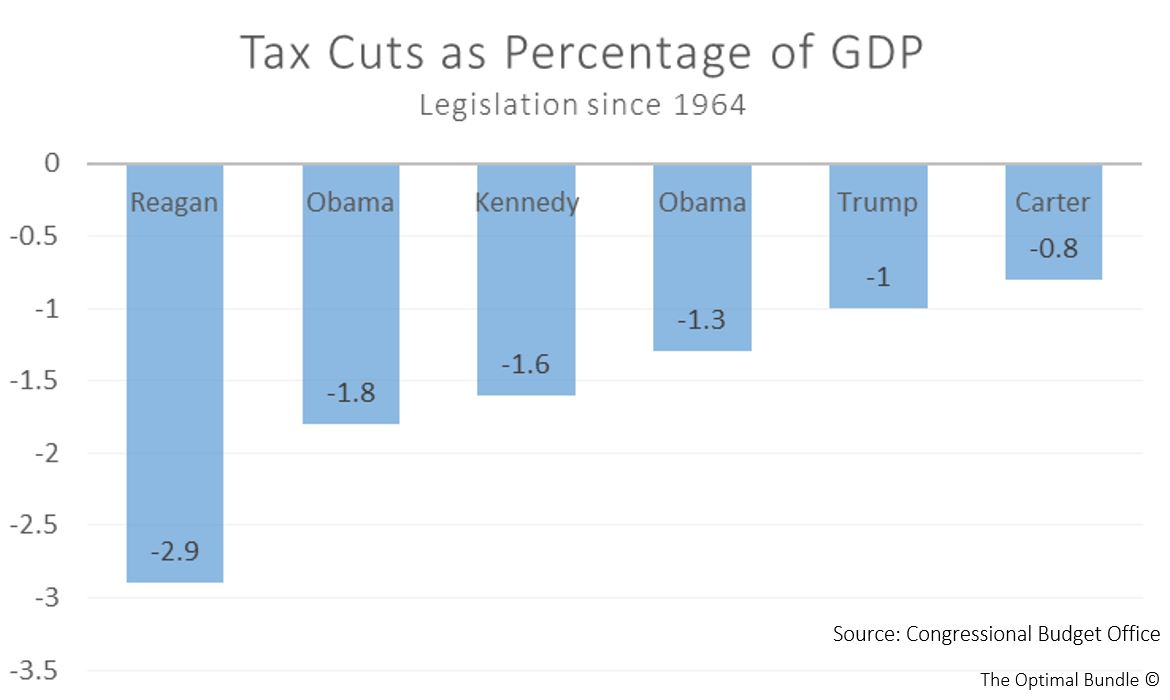

The newly passed tax bill, officially legislated as H.R. 1 or Act to Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018, was signed into law by President Donald Trump on December 22, 2017. It passed through the House of Representatives and the Senate along party lines. According to the bipartisan Committee for a Responsible Federal Budget, H.R. 1 includes the eighth largest tax cut since 1918 and the fourth largest since 1949 when adjusted for inflation. It is American firms that are projected to reap most benefits from the new tax bill. For example, Warren Buffett’s Berkshire Hathaway is expected to have a twelve percent increase in profits resulting in a $37 billion gain. In the short-run, both corporations and employees will see benefits resulting from the tax reform, but more time is required in order to see other, more complex effects such as a likely increase in the national deficit. A report released by KPMG immediately following the enactment estimates that the law provides an overall tax reduction of $1.456 trillion over the next decade when not accounting for the fluctuations of the business cycle. One of the provisions within the new law includes the permanent repeal of health care subsidies and the mandate that requires all individuals over the age of twenty-six to join a health insurance system, both which were part of the Affordable Care Act, the Obama Administration’s flagship piece of legislation. Repealing the individual mandate is estimated to reduce the federal deficit by $338 billion within a period of eleven years, but result in 13 million Americans not obtaining health insurance while premiums are projected to increase by ten percent.

According to estimates by Harvard economist Robert Barro, cutting the average marginal tax rate for individuals by 1% will increase GDP by 0.5% over the next two years. In other words, a cut in tax rate will increase the amount of disposable income available to the citizens thus increasing their purchasing power. This will tend to have an expansionary effect on the economy as consumer spending and investment is likely to increase.

Such change in fiscal policy affects several sectors of the American economy. One effect that has been analyzed so far is how the corporate tax cuts within H.R. 1 is affecting activity in capital markets. Currently, the stock market is thriving and many, including the president himself, believe that such growth is catalyzed by the recent tax overhaul.

“Just a few weeks after major tax reform legislation was approved by Congress and signed by President Trump, we are seeing the broad benefits of economic growth...The Dow has climbed to a new all-time record, over 26,000 in the past few days. That reflects $7.2 trillion in new wealth added to the economy over the first year of the Trump presidency, broadly shared by everyone with stock ownership, either directly, or through pension plans and retirement savings.”Lewis K. UhlerFounder, National Tax Limitation Committee

In a January 11 interview with the Wall Street Journal, President Trump told a reporter that, “The tax bill has turned out to be far greater than we ever anticipated… It’s selling itself.” The President's confidence is not left unsupported. Trend Macrolytics LLC Chief Investment Officer Donald Luskin stated that since the passing of the tax bill, Wall Street Journal analysts have increased their projections for earnings in the S&P 500 by an unprecedented 4.6%. Due to the corporate tax cut from 35% to 21%, a confidence boost in the stock market has led to its noticeable growth. Warren Buffet voiced his opinion regarding the tax cut to CNBC, “You had this major change in the silent stockholder in American business who has been content with 35 percent ... and now instead of getting 35 percent interest in the earnings they get a 21 percent and that makes the remaining stock more valuable." While there are pundits and analysts issuing warnings about an impending stock market crash, it is important to remember that markets are dependent on consumer confidence. Bullish activity reveals that at a minimum, investors are confident about the future of the economy under the Trump presidency. In the days following the passage, corporations like Wells Fargo, Bank of America, and J.P. Morgan announced cash bonuses for thousands of their employees, partly due to reinvigorated incentives. The drive for investing means that people are betting on economic success, increased real wages, and higher business profits. All of the effects that the tax cut has had on the stock market seem to be positive due to growth. However, it is important to keep in mind that while this growth enthuses C-suite executives, polls reveal that it does not do the same for a significant portion of the public. The middle class and lower income earners will see mixed results. The Institute on Taxation and Economic Policy analyzed the H.R. 1 to see how tax cuts and hikes were distributed across income percentiles and across time as provisions within the bill change the tax rates by year. These figures also factored in the elimination of the penalty on the healthcare mandate, which is a small tax cut in itself for the lower income earners. The middle 20% of income earners will see a reduction in taxes of about 1.5% in the first years of the bill and that will slowly decrease over time with the 2027 estimate being a net zero change in taxes. The lower middle class, the bottom 20%-40% of income earners, will benefit similarly in 2018 with an expected reduction of 1.3% in taxes that will shrink to a net .5% increase in taxes by 2027. The 60%-80% of income earners will do slightly better with a reduction of 1.6% on their federal taxes to start and a net neutral tax effect by the bills end. By far the winners of this tax bill were the top 10% of income earners who will see reductions of close to 5% on their tax bills and will see slightly smaller decreases through time.The Tax Foundation’s analysis centered on the benefits to hypothetical households involved during the bills early stages in the late 2010s and found that every income level will benefit from the new tax bill. The lower marginal tax rates coupled with a larger standard deduction were the primary reasons for lower taxes among the middle and lower class groups. A larger and more accessible child tax credit is a potential benefit for families in the middle of the income distribution. These calculations were made without factoring in the effect of the individual healthcare mandate and ignore the changing nature of the bill over time.One unlikely entity that will be negatively affected by the new tax bill is Penn State Football. Previously, alumni and other boosters could write off the cost of season tickets and luxury boxes as tax-deductible charitable contributions. According to the newly revised tax code, buying the best seats for a Penn State football game is not considered a charitable donation and is not included in the new law. At the University of Georgia the right to buy luxury box seats can cost $60,000 a year, which was tax deductible. It is now likely that demand for luxury boxes could fall.___________Nicolas Guerrero contributed to this essay. Featured Image:Ben Aronson (1958-present) AmericanSunset, Chicago River (2014) Oil on Panel BibliographyThe First Trump-GOP Tax Bill: National and 50-State Analysis. Institute on Taxation and Economic Policy. December 2017. https://itep.org/wp-content/uploads/Trump-GOP-Final-Bill-Report.pdfLorin, Janet; Novin-Williams Eben. College Football Teams Mount Blitz to Lock In Donors' Tax Breaks. BloombergPursuits. December 22, 2017. https://www.bloomberg.com/news/articles/2017-12-22/college-football-teams-mount-blitz-to-lock-in-donors-tax-breaksShell, Adams. List of companies that paid bonuses or boosted pay since tax bill passed. USA Today. January 11, 2018. https://www.usatoday.com/story/money/2018/01/11/list-companies-paid-bonuses-boosted-pay-since-tax-bill-passed/1023848001/Buhayar, Noah. Berkshire to Reap Estimated $37 Billion Bump From U.S. Tax Cut. Bloomberg LP. January 8, 2018. https://www.bloomberg.com/news/articles/2018-01-08/berkshire-to-reap-estimated-37-billion-bump-from-u-s-tax-cutEl-Sibaie, Amir. Who Gets a Tax Cut Under the Tax Cuts and Jobs Act? Tax Foundation. December 19, 2017. https://taxfoundation.org/final-tax-cuts-and-jobs-act-taxpayer-impacts/Rep. Brady, Kevin. (R-TX) [Sponsor]. United States House of Representatives - 115th Congress (2017-2018). United States House of Representatives Ways and Means Committee. H.R.1 - An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018. Public Law No: 115-97. December 22, 2017. https://www.congress.gov/bill/115th-congress/house-bill/1New Tax Law (HR1) Initial Observations. Klynveld Peat Marwick Goerdeler [KPMG] December 22, 2017. https://home.kpmg.com/content/dam/kpmg/us/pdf/2017/12/tnf-new-tax-law-dec22-2017.pdfTranscript of donald trump interview with the wall street journal. (2018, Jan 14). Wall Street Journal (Online) Retrieved from http://ezaccess.libraries.psu.edu/login?url=https://search-proquest-com.ezaccess.libraries.psu.edu/docview/1987216534?accountid=13158Luskin, D. L. (2018, Jan 12). Tax reform has released the bulls. Wall Street Journal Retrieved from http://ezaccess.libraries.psu.edu/login?url=https://search-proquest-com.ezaccess.libraries.psu.edu/docview/1986575861?accountid=13158Kim, Tae. Warren Buffett says 'huge' corporate tax cut is 'not baked in' stock market. CNBC. January 10, 2018. https://www.cnbc.com/2018/01/10/warren-buffett-says-huge-corporate-tax-cut-is-not-baked-in-stock-market.htmlHarper, Jennifer. Desperate Trump critics rage against the stock market boom. The Washington Times. January 18, 2018. https://www.washingtontimes.com/news/2018/jan/18/though-the-economy-appears-to-be-humming-and-happy/