Demonetization in India

India is a country with the world’s second largest population. About 1.38 billion people call India their home. To control such a huge population and to cater to the necessary needs of people below the poverty line, the government has always ensured to formulate policies that would benefit everyone. Not only were the policies beneficial for the Indian citizens but they were also intended in turning the status of India from a developing nation to a developed one. However, the prime minister, on the night of November 8, 2016 declared a policy that baffled the whole nation. The real question is what made this policy so much controversial and questionable!

On the night of November 8 2016, the Indians were struck with the most controversial policies of all times: Demonetization. The government decided to ban the 500 and 1000 rupees notes overnight. They were the most used currency notes among the Indian citizens. The prime minister made a live appearance on the national television at around 8:07pm and bombarded the Indians with such a bizarre policy. Prime Minister, Narendra Modi declared that he took such a step as he wanted to curb black money and eradicate corruption prevailing in the country. This however was not taken as positively as the government thought the citizens would. It was considered to be the most uncalled for policy that was taken overnight without the consent of any other political parties or the citizens. There was turmoil all across the nation affecting almost 86% of population, keeping in mind that 74% of the population work in the primary sector and their income is so less that they don’t have the capacity to fend for their family’s daily necessary needs all alone. People were seen standing in long ques outside the ATMs to get other currency notes like 100s and 50s so that they could at least use them for the time being till the government gives any other decision. Many farmers committed suicide as they couldn’t get the appropriate amount of money in exchange for their notes, and now they were left with barely anything to afford for their family. The worst part about this whole move was that, now the bankers and exchange markets were further taking advantage of the vulnerable section of the society thus increasing the amount of corruption and politics which the government had promised to curb while declaring the policy. The second worst hit department were the airlines industry. Many popular Indian airlines industry lost their license and funds to run their company, and had to shut down leaving the employees jobless. There were reports of mass suicides of air hostess and cabin crews which shook the whole nation. This was considered to be a fine opportunity for the bankers to use the poor people as cash mules. In India the government “apparently helps” the poor people by opening a bank account for them where they can store their funds and access all financial services. This policy is known as Jan Dhan Yojana. Now with the demonetization policy the bankers considered this as an opportunity to hoax the needy people. As more and more people deposited their cash in banks, the bankers converted and kept a large portion of the converted currency with themselves by falsely claiming that, that amount was stored as a safety deposit when in reality the cash would never made its way to the poor. Several reporters reported that 30% of the deposits were never kept safe in the bank but were sent as bribes to the rich people who were drowning in their black money in exchange of a large sum. With such a chaos in the country, the government decided to hide the flaws of the policy by taking out 2000 rupees currency notes which further escalated the black money instead of curbing it now. This is because now the ones with black money were able to hide it more with the increasing value of the currency notes.

This policy was nothing but a huge overnight menace for the society. Instead of doing good to the citizens it was indirectly serving as an aid to the rich ones who were supposed to suffer because of the illegal money that they possessed. However whatever policy the government imposed on true voters in name of good will, suffered the most as they worked day and night to earn their hard-earned money and now were subjects of a mismanaged plan that was not given enough time to be thought about. Some feel that it was intentionally carried out to seize the funds of people who don’t have enough say in the society. While on the other hand the Prime Minister declared that, the decision was taken all of a sudden as he didn’t want to give enough time to the ones with black money to convert it to white and live their lives peacefully without facing any trouble or getting arrested for the crimes, they had been doing till date without falling in trouble. However, the citizens didn’t were not quite satisfied with the decision as well as the reasoning as it had many loopholes and cost many lives. Till date this topic is still debatable. Was it the right decision on part of the government to take this step?

The Dark Side of Venmo

“Just Venmo me back!” I’m sure we’ve all heard it before, and even have said it ourselves. Apps like Venmo, Cash App, and PayPal have made splitting bills and paying friends back quick and painless. Rather than having to track someone down to hand them cash or a check, money can be transferred with the press of a few buttons. All you need is a bank account and a smartphone and practically everyone has one of those. Venmo was founded in 2009 and has become a popular mobile payment service as an estimated 76 million people use it. Once your account is set up and connected to your desired bank account, you can begin connecting with friends and family members. Money sent to your Venmo account can then be transferred to your bank account after one to three business days. Instant transfers can be made for a small fee, but most users choose to avoid the fee. Unsurprisingly, illegal transactions and scammers have found their way to Venmo, making black market activities easier as well.

In 2018, Congressman Matthew Gaetz was tied to Joel Greenberg, an accused sex trafficker, through Venmo transactions. Venmo requires users to type in descriptions for each payment, and Greenberg made three payments to three young girls under the descriptions “Tuition” and “School.” At first, one may breeze past this without a second thought, but when digging deeper in the case, there are suspicions pointing towards prostitution. Human trafficking, which can force people into prostitution and child labor, is one of the largest black markets. Venmo is a frontrunner for drug deals as well. College students have been arrested on campus for selling drugs once police found evidence of consistent Venmo transactions with descriptions relating to marijuana. A survey of 1,200 millennials revealed that nearly one third of them admitted to using mobile payment apps to purchase drugs. Venmo also serves as an additional platform for scamming. Recently there has been many individuals illegally obtaining money from COVID-19 relief programs and scammers tricking Venmo users who are desperate to make quick cash. Scammers filed for unemployment using false information during the pandemic. The government was doing their best to disperse money out to those in need as fast as possible, so the fake reports were able to go unnoticed temporarily. The funds were transferred to various people through mobile banking apps or through the creation of new debit cards. Scammers on Venmo would ask people for $1 and claim they could turn it into $10. To gain trust, the transactions are successful in the beginning. Then, users start giving $10 hoping it will turn into $20, giving $20 hoping it will turn into $50. Soon they discover the truth of the scam when money is no longer returned to them. Not only does using Venmo provide a platform for scamming to occur, but it benefits the scammers. Using Venmo makes it more difficult for money trails to be traced. Black markets and scammers are inevitable and nearly impossible to eliminate, but how exactly do they affect the economy?

Black markets are economic activities that take place outside of government sanctioned channels and include illegal and legal goods. Legal goods are usually traded on black markets to avoid taxes – a large quantity pertaining to clothing and shoes. Estimates of the size of the black market in the United States vary widely: Some as low as 5.4% of the United States’ gross domestic product up to 12%. This may sound like a small portion, but it translates to about $1.5 trillion to about $2.4 trillion. Tax revenues that should be collected on these transactions could provide funding for government programs each year like Temporary Assistance for Needy Families or Medicare. Other drawbacks to underground transactions include susceptibility to fraud, violence, and counterfeit goods due to lack of regulation. Profiting off people’s misfortune is easily obtainable in black markets too. Items in short supply in certain areas that are vital for someone’s health can be charged a premium well above face value. Many argue this practice is highly unethical, but those in need of the supplies view the choice of paying high prices an easy decision. Looking at past patterns of the black market raises questions about the current state of these illegal transactions.

The undocumented aspect of the black market obviously makes it difficult to tie it to concrete numbers, but some economic trends and patterns in the United States reveal the levels of black-market transactions. During the 2008 recession, it appears the black market was brought back to life. The worst years of the recession had a decline in the labor force with high unemployment levels, yet there was increasing currency in circulation and retail sales. Although the United States is technically no longer in the pandemic induced recession, the economy still needs time to heal. Given the relatively stagnant labor force participation rate, pictured to the left, and the increasing retail sales, pictured at the bottom of the page, the same pattern may be emerging. After being in an economic lock down for an extended period, a desirable career now includes the option of working from home, but not all jobs can accommodate this need. However, black markets can meet this requirement especially with apps like Venmo; therefore, making black market activity appear desirable. But black markets are inevitable, so is Venmo at fault for their consumers’ choices? Venmo is taking action to counteract black market activity and fraud. Robots scan through descriptions on the app looking for phrases indicating illegal activity. Users also get notified about suspicious and untrustworthy accounts that may be scammers. No matter how much caution Venmo takes, it appears the ease and speed of the app will always entice criminal affairs.

FinTech to Scale: Trends & Predictions for 2022

2021 signified a year of unprecedented growth in various digital realms, along with an increase consumer demands for personalization. This macroscale shift in customer experience expectations has left industries, markets, and the firms of all sizes that operate in these domains to accelerate their digital transformation strategy and the subsequent initiatives derived from it.

Financial technology, more commonly referred to as fintech, has experienced growth in both global funding and solution scope in 2021 alongside its industrial counterparts. This marks a point of inflection for fintech, with shifts rippling through the industry stakeholders, including FIs (financial institutions), finserv (financial services), and Big Tech. This developmental push for technological innovation in fintech and its operating industries has cultivated the widespread usage of fintech tools, which have manifested in a retail trading boom and increased uptake in the adoption of more modern fintech offerings, including cryptocurrency.

Based on the scalar effect that tailored solutions and redefined consumer expectations and behavior, fintech startups, incumbent financial institutions, and Big Tech firms will increasingly require the ability to deliver a hyper-personalized customer experience in the realm of banking and investing. These stakeholders are able to propagate these demands through pivoting embedded fintech solutions into already-existing platforms used by their customers. This viability necessity illustrates the continually growing rejection by consumers at the one-size-fits-all model for banking and financial services.

Increase in FinTech Funding

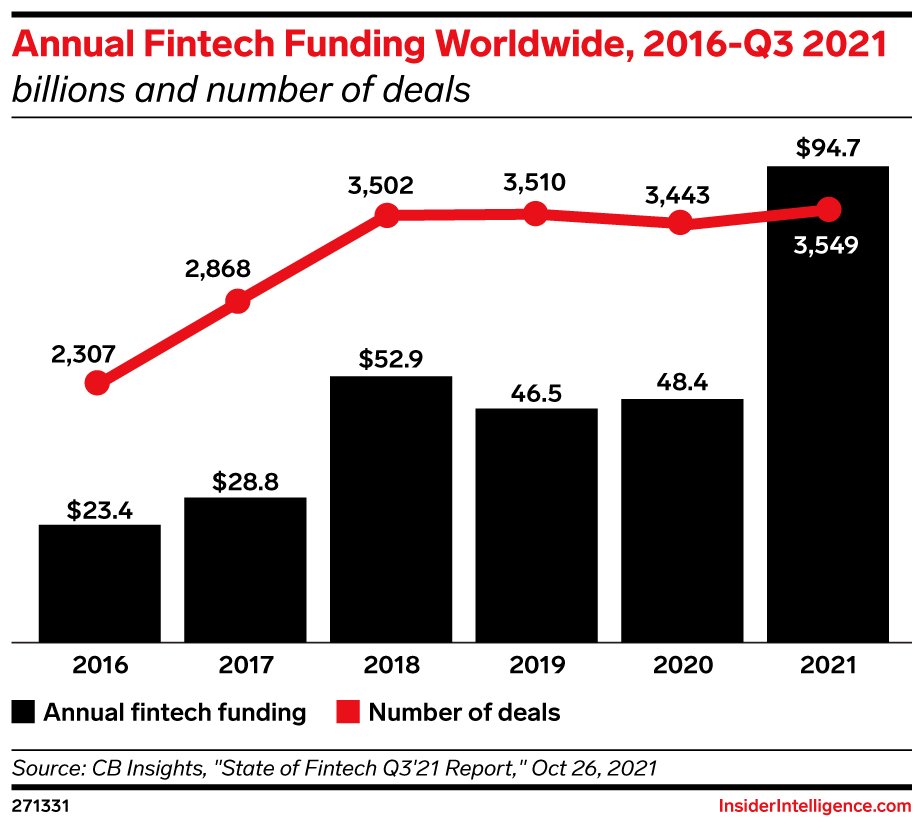

In the first three quarters of 2021 (Q1, Q2, and Q3), global fintech funding reached $94.7 billion, a value slightly less than the total funding for fintech in the last two years combined.

With this significant rise in funding on an international level, it is evident that fintech is shifting towards banking and finserv solutions that are optimized to the digital ecosystem of each individual consumer.

A sub-trend that has cultivated out of this shift in customer demands shows that fintech will utilize an increasing pool of funding to focus on delivering solutions to traditionally underserved customer segmentations. In 2022, this emphasis will likely be demonstrated by a shift towards solutions aimed at inclusion, employee wellness, and additional segmentation.

The alignment of personalized, customizable solutions in these three focus areas can be shown by Greenwood, First Boulevard, and Daylight, neobanks that are segmented to the Black, Latinx, and LGBTQ communities respectively. Within the employee wellness concentration, there will exist a greater examination of the banking and finserv needs of hourly-wage and salaried employees. An example of this 2022 trend is evident in Origin and CloudPay, two platforms offering in-demand services like earned wage access directed towards this labor classification.

Another manner for which consumer trends will union with fintech operations is in credit-building. 2021 materializations of this credit-access objective is exemplified by the offerings implemented by JPMorgan and Wells Fargo.

Additionally, innovations and applications of fintech have prompted the proportional rise of insurance technology, commonly denoted as insurtech. Similar to fintech global funding in Q1-Q3 2021, insurtech experienced Q3 2021 funding of $10.5 billion, a major increase as compared to their $7.1 billion in funding for all quarters of 2020. Key insurtech stakeholders have advanced their attention to rebundling insurance and providing optimized insurance solutions that seamlessly synchronize with other consumer-available solution channels.

Big Tech in FinTech

The relationship between tech companies and banking firms will be marked by the mutually-beneficial interests each entity seeks to fill, including cloud development contracts and advertising partnerships. Moving into 2022, Big Tech firms will continue their entrance into the fintech and finserv industries and increasingly orient their objectives within banking and insurance.

Big Tech is mainly entering fintech, finserv, and banking through embedded financial. Embedded finance is the inclusion of financial solutions within customer experiences and channels for nonfinancial purposes. A familiar and successful incorporation of this amalgamation is seen by Apple, which has engaged highly-profitable segments through rolling out features directed at integrating customer banking, payment, and insurance experiences in a single channel and operating system. Based on the model deduced from embedded finance initiatives and outcomes at Apple, many other companies can be expected to look for ways to bring embedded finance into their business and revenue model in 2022. This effort will likely include retailers, car manufacturers, and software companies, all industries where deployment of embedded finance is logical and intuitive for the scope of daily operations.

Based on the behavior of fintech firms and fintech integration in dominating entities, banking is predicted to be the next industry for which embedded finance attempts to enter in 2022. Incumbent banks and FIs will turn to Big Tech to implement these fintech solutions, conducive to the historical avoidance of Big Tech firms to regulations and operational complexities that frequently accompany the banking industry.

Cryptocurrency

In 2021, the trading and investing industries experienced large-scale growth in retail trading and cryptocurrency on top of experiencing diverse market oscillations, like that due to the r/WallStreetBets GameStop saga. As trade volume decreases moving forward into 2022, the demand by retail investors for day trading will fall, with cryptocurrency becoming the main revenue driver for trading platforms and applications. To combat the risk of decreased revenues in 2022 due to diminished trading volume, trading platforms will push forward efforts to divulge new profit sources. These sources may include offering additional coins for crypto trading and providing crypto-wallets to users, allowing them to receive cryptos without the necessity of converting them into fiat currency.

As fintech is utilized to differentiate unseen trading solutions for revenue drivers, social trading will become an increasingly vital element of trading platforms. In 2022, these platforms and apps will rollout lesser-revenue solutions to users, including inclusion in IPO purchases and long-term investing offerings (such as retirement funds).

DeFi in FinTech

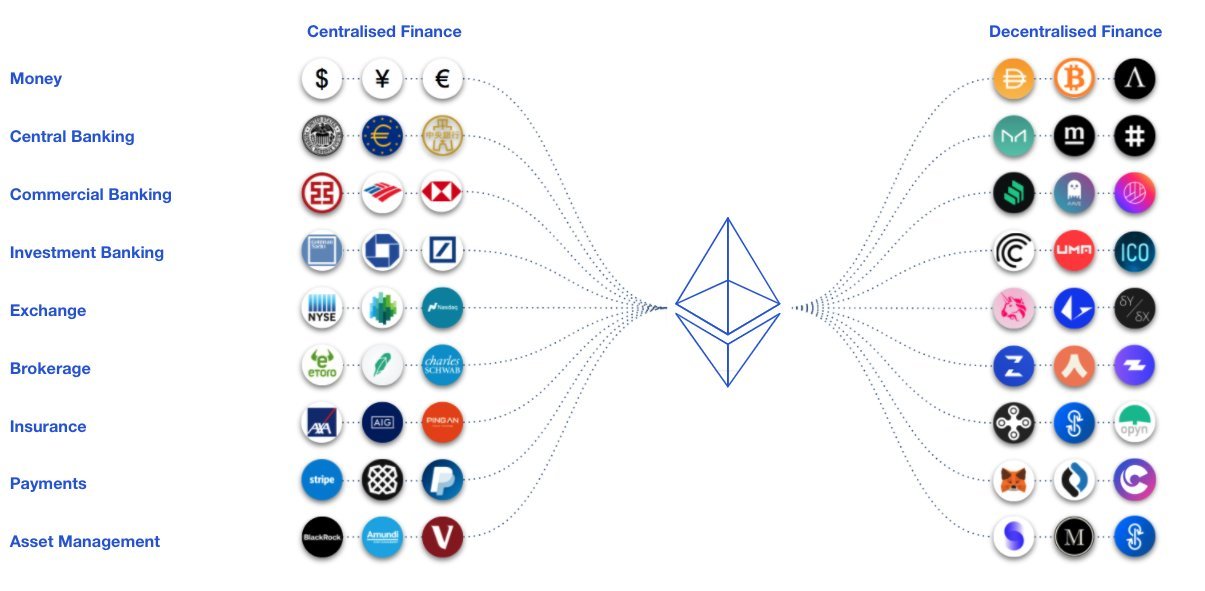

Decentralized finance, also known as DeFi, is a protocol framework for fintech that relies on agreements that enter a loop and are automatically enforced with code on a blockchain, removing a majority of financial intermediaries in the process. Despite a decrease in crypto day trading volume in Q3 2021, additional adoption of crypto will be driven by a combination of incumbent FIs and fintech startups to implement these DeFi protocols into their solutions suite.

As this trend is bespoke moving into 2022, crypto and DeFi usage will become rapidly normalized into daily consumer and business operations as FIs, social media platforms, and developers begin to enter the fintech market. This trend will likely be evident in FIs launching and deploying their own crypto solutions using DeFi, as well as the derivation of new solutions grown out of new stakeholders in fintech and retail trading. Some of these new solutions include play-to-earn models in videos games and crypto tokens on social media sites.

Sources

Demonetization in India

Sanyukta Talukdar

https://www.babson.edu/academics/executive-education/babson-insight/finance-and-accounting/indias-demonetization-what-were-they-thinking/

The Dark Side of Venmo

Julia Kwitkowski

https://www.thedailybeast.com/gaetz-paid-accused-sex-trafficker-who-then-venmod-teen

https://online.pointpark.edu/criminal-justice/underground-economy/

https://fortune.com/2017/07/10/venmo-app-buy-drugs/

https://www.investopedia.com/terms/b/blackmarket.asp

https://fred.stlouisfed.org/series/RSXFS

FinTech to Scale: Trends & Predictions for 2022

Colin Spellman

https://consensys.net/blog/codefi/explain-defi-to-your-dad/

https://content-na1.emarketer.com/insider-intelligence-fintech-trends-watch-2022