The Federal Reserve Explores Central Bank Digital Currency Options

The central bank of the United States, the Federal Reserve System, is responsible for the performance of five critical functions to ensure the effective operation of the American economy. These five mandates include conducting monetary policy along with promoting financial infrastructure stability, the safety and coherence of financial institutions, and consumer protection and development. While these five objectives have long dictated the central bank’s behavior, the Federal Reserve has recently released Money and Payments: The U.S. Dollar in the Age of Digital Transformation, a document outlining the potential creation and implementation of a central bank digital currency (CBDC), along with possible benefits and risks of cultivating such a currency. The release of this information, along with the actions it discusses, signify an important transformation for the central bank in terms of its mandate and goals.

The Federal Reserve, who bears the responsibility of maintaining the American payment system, has evolved its approach over time. These methodologies for promoting the stability and safety of the U.S. payment system have historically ranged from controlling interbank payment systems to developing an automated clearinghouse (ACH) system as an alternative for paper checks. In 2019, the Federal Reserve added to its payment system regime through construction of the FedNow Service, a real-time interbank system that is expected to debut in 2023. While these innovations have allowed the U.S. economy and dollar to maintain its role as the world’s reserve currency, recent technological growth has brought about an unprecedented surge in private-sector financial products and services. These offerings, including digital wallets, mobile payment applications, and novel digital assets like cryptocurrencies and non-fungible tokens (NFTs), have spurred central banks- both at home and abroad- to explore the implications of issuing a CBDC.

The Federal Reserve is currently researching and examining the potential pros and cons of issuing a CBDC, which can be defined as a digital liability of the Federal Reserve that is widely available to the public. A potential CBDC would not be the initial exposure of Americans to digital money, however. Americans have predominantly held money in a digital format for a substantial length of time, as evident by bank accounts recorded as computer entries on commerical bank ledgers. Despite this, a CBDC would vary from the existing digital currency structures Americans possess access to today in that a CBDC would not be a liability of commerical banks and rather of the Federal Reserve.

In the U.S. economy, money is represented in a multitude of forms. These forms include central bank money, commerical bank money, and nonbank money. Central bank money, like a potential CBDC, is a liability of the Federal Reserve and is outputted in the form of physical currency issued by the central bank. This type of money carries neither credit nor liquidity risk and is generally considered the safest form of money. Commerical bank money is the most common digital currency used by the public, holding very little credit or liquidity risk due to federal deposit insurance. Nonbank money is digital money held as balances at nonbank financial service providers. While nonbank money may be shared in convenient mediums (like mobile apps), it lacks the full range of protections afforded to commerical bank money, causing it to carry more credit and liquidity risk. Obviously, central bank money acts as the foundation of the financial system and overall economy, and the other forms of money are denominated in and easily convertible to central bank money.

While the current payment infrastructure and system is generally effective and efficient for the operation of the American economy, there are a host of certain challenges that continue to persist despite increasing technological innovation. More than seven million Americans (5% of U.S. households) remain unbanked, and about 20% of U.S. households have bank accounts but still rely on outdated and costly financial services. Additionally, cross-border payments have facilitated some of the most complex issues in the U.S. payment system, with friction deriving from the mechanics of currency exchange, variations in legal regimes and technological infrastructure, and coordination problems among intermediaries. This cross-border dilemma is exemplified by the average cost of sending remittances from the U.S. to other countries being 5.41% of the notional value of the transaction.

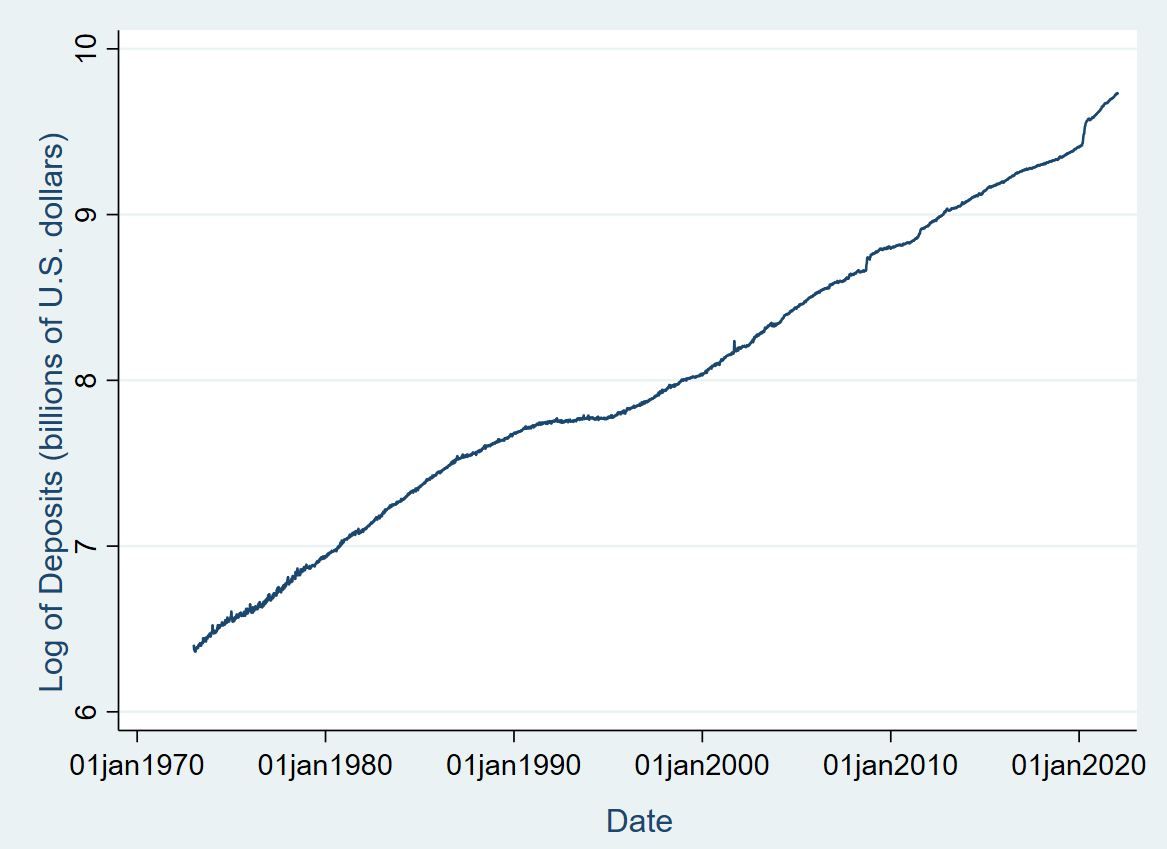

Time series plot of the logarithm of weekly currency levels data from 1970 to 2020

Data Source: FRED (Federal Reserve Economic Data)

A crucial examination of a U.S. CBDC is whether this CBDC would prove superior to other methodologies seeking to address the payment system issues discussed above. A CBDC would enable the American public to make digital payments as a liability of the Federal Reserve, therefore removing the necessity of mechanisms like deposit insurance and serving as the safest digital asset available if created. A CBDC would also require privacy-protection, intermediation, and identity-verification. Under an intermediated model, the private-sector would offer accounts or digital wallets to accelerate the management of CBDC holdings and payments, operating in an open-market structure.

There are a plethora of variegated advantages to the creation and implementation of an American CBDC. Some of these benefits include bridging the gap between legacy and new payment services, maintaining the centrality of safe central bank money in a rapid digitizing economy, and level the playing field in payment innovation for firms of all sizes. On top of these contributions, a CBDC could be used to carry out micropayments, streamline cross-border payments, reduce common barriers to financial inclusion, and preserve the dollar’s role as the international standard.

Discussion of a Federal Reserve CBDC reflects the growing shift away from physical currency to digital currency. Cash use by Americans fell from 40% of transactions in 2012 to 19% in 2020, and other countries have experienced even more aggressive declines in usage.

95% forecast interval for the logarithm of currency based on linear trend model

Data Source: FRED (Federal Reserve Economic Data)

The wide range of potential usages and benefits of a U.S. CBDC are accompanied by risks and essential policy considerations. Some of these concerns stem from creation of an interest-bearing CBDC, which could cause a substitution effect to occur away from commerical bank money to CBDC, shifts away from traditionally low-risk assets, and flight-to-safety issues during recessions and financial crises. Many of these potential CBDC risks could be mitigated or removed by creation of a non-interest-bearing CBDC, as well as limiting the amount of CBDC an end user can hold or accumulate over short periods of time.

In conclusion, even though the Federal Reserve’s recent release of information regarding a CBDC is purely to gauge feedback and insight from the American public and corporations, the creation and implementation of a U.S. CBDC in the future is arguably inevitable. As digitization continues to manifest and take hold in many markets and industries, the Federal Reserve has begun extensive research into emerging technologies conducive for a CBDC, such as blockchain, distributed ledger for wholesale payments from bank-to-bank, using darknet data to reduce fraud, and programmable money. Nevertheless, it is evident that the development and rollout of a CBDC will have critical implications on financial markets, payment systems, and our relationship to money in general.

India as Global Supply Hub: A Strategic Examination

The COVID-19 has posed a great threat to the uprising economy of many international markets. It has disrupted the smooth functioning of several industries that were growing and has brought down many well-established firms and economies down. With India and the other countries in the world still combating an unprecedented global pandemic, it has become the need of the hour to formulate and implement policies and programs designed to uplift and boost the economy especially in developing countries. This is due to the fact that developing nations need the taxes and funds to procure capital, improve technology, grow, and expand.

India is a developing nation which has been thriving in the economy due to its large production and exports of industrial goods and services. However, as the pandemic started it caused an upheaval in the economy, thus causing a major setback in the growing and upcoming industries. As India is one of the core manufacturing and supply unit, the Indian Business Council and Economic Laws Practices conducted a survey to solicit recommendations on the policy reforms, regulations, and incentives that will make India a greater and more attractive investment destination. Efforts are being made to monitor all the economic sectors closely and bringing major changes in them for the improvement especially in such a disruptive global outbreak of uncalled for circumstances. According to sources it was further believed that in order for India to achieve and gain what larger economies in the society enjoy, India’s supply chain and logistics ecosystem needs to be standardized. India has a system of modern marketing with skilled labor that is an integral and essential part for building the economy and giving a shape to the society. However, the greatest hurdle and hindrance for it is the that products manufactured in India are strictly moved to domestic and international markets. An economic system that is standardized will help the overall face of economy of India. As India moves along the path and trajectory of a leading logistics hub; connecting Asia to Middle East, Europe, Africa and beyond, it has become the need of the hour to act upon it and do custom modernization and trade facilitation reforms that will attract new supply chains to India. The Indian government recently emphasized and stressed a lot on the “make in India” concept where the government basically wished for keeping India as the manufacturing hub instead of depending on China and moreover any other country. Thus, the reforms are extremely essential and vital to India’s growth in manufacturing under the “make in India” agenda. They can support increased exports and turn India’s level of attractiveness for foreign and multinational companies higher, thus overall helping the micro, macro, and small companies that have just started the journey. Various supply chain practices and real-world trials are being undertaken under the supply chain market to standardize the supply chain and logistics ecosystem. This will be a “dream economy” for the government as it will not only affect and boost India’s economy positively but help India in getting to a higher position on the economy while not depending on any other economy and their units. With this multinational will seek to move manufacturing to nations that to preserve can both balance continued production and handle future crisis to preserve core capabilities and avoid major supply chain disruptions. Thus, it can be interpreted that supply chain resilience has become as important as supply chain efficiency. Therefore, now the white paper, Shifting Global Value Change noted that while having a catastrophic effect on economy and global value chains due to COVID 19, India is well placed to have a much larger role as they are reconfigured as parts of effort to build resilience. It was noted that gradually due to the government opening of new opportunities in the market, there was a significant rise in the workforce thus encouraging manufacturing and aiding to be in a better word rank. The government has planned to upscale the workforce by 2030, so that they can fully depend on their own manufacturing units all alone.

The study by Kearney provides five ways in which India could realize its manufacturing potential in the market. These include coordinated action between government and private sector to help create globally competitive manufacturing units, shifting from cost advantage to workforce skilling, innovation, quality, and sustainability. The pandemic has accelerated new changes which include emerging technologies, sustainability drive and reconfigured value chains as reported by WEF. With COVID 19 adding fuel to these changes it has become the need of the hour to secure a place in tomorrow’s global economic system. Thriving manufacturing sector would help India deliver on the imperatives to create economic opportunities for nearly 100M people likely to enter the workforce to distribute the wealth equally. This will help India in gaining an improved position as more people would be contribution in making the economy and manufacturing units ride higher strides than any other international market and improve their position globally and emerge as a leading hub in the society.

Sources

The Federal Reserve Explores Central Bank Digital Currency Options

Colin Spellman

https://www.federalreserve.gov/newsevents/pressreleases/other20220120a.htm

https://fred.stlouisfed.org/series/MBCURRCIR

StataBE 17

India as a Global Supply Hub: A Strategic Examination

Sanyukta Talukdar

https://www.cips.org/supply-management/news/2021/august/india-could-become-a-hub-of-global-manufacturing/#:~:text=India%20has%20the%20potential%20to,the%20global%20economy%20by%202030.

https://www.weforum.org/press/2021/08/india-s-opportunity-to-become-a-global-manufacturing-hub/

https://www.silkroadbriefing.com/news/2022/01/26/china-plus-central-asia-meeting-draws-eurasian-security-and-trade-closer-together/