The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about the NFL's response to Georgia's religious liberty laws. Other topics in this edition include the cost of U.S. presidential primary elections, disparate price fluctuations in the real estate market and their implications for socioeconomic class, and the Fed's decision to leave the target federal funds rate unchanged. This is an online version of the print edition of the Optimal Bundle.

Modern Antitrust Developments: Evaluating Corporate Leniency Policy

By Trevor Baumgartner

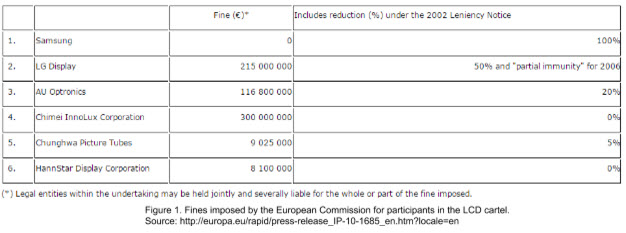

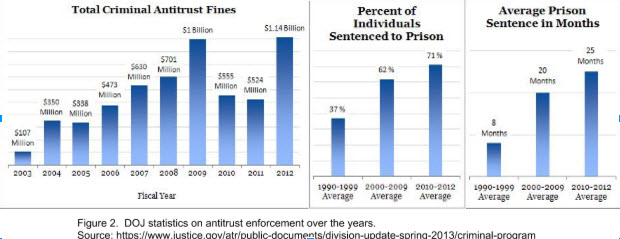

A Brief Introduction to CartelsOn September 20, 2012, the United States Department of Justice fined AU Optronics, a Taiwanese LCD manufacturer, $500 million for their participation in a price-fixing scheme--the largest single fine imposed on a firm for violating anti-competitive laws. This landmark sentencing was the result of an ongoing investigation into the LCD cartel, which has thus far resulted in $1.39 billion in criminal fines as well as jail sentences for 12 executives at the eight firms in question. Fines imposed by the European Commission for European commerce affected by the cartel are shown in Figure 1 below. Historically speaking, cartels have been present in a wide range of industries, with heavy concentration in the vitamins, auto parts, and electronics industries. Oligopolistic industries in which firms produce goods with little to no product differentiation are especially susceptible to cartel formation. If firms are unable to differentiate their product, the price of the product is driven down to a point near the marginal cost of production. Collusion then seems a natural solution for firms to ensure a favorable profit margin that would otherwise not be achievable. Cartel formation allows firms to function as a monopoly in their respective industry--giving them collective bargaining power in terms of uniformly raising prices or restricting output, or both. The large fines imposed on firms participating in cartels are a testament to the extent to which cartel activity disrupts pure market competition, and therefore warrants government enforcement. We seek to analyze the impacts and efficacy of government antitrust policy in an effort to determine what existing incentives remain for firms to collude. Leniency PolicyGovernment scrutiny of anticompetitive practices dates back to the passing of the Sherman Antitrust Act in 1890. Under the Sherman Antitrust Act, any contract or conspiracy in restraint of free trade was declared illegal, and those in violation of the act were subject to heavy fines or jail time. Public response to the act was mixed, with those in favor arguing that it protected consumer surplus by preventing monopolies from raising prices and thereby ensuring pure competition between firms. Those against argued that the act was in violation of the free market and ultimately failed in its intent to prevent unfair pricing by reducing economies of scale.On August 10, 1993, the United States Department of Justice (DOJ) adopted new legislation known as the Corporate Leniency Policy. Prior to this legislation, leniency (or partial leniency) was granted on a discretionary basis for firms that aided the DOJ in cartel investigations. Under the new guidelines, amnesty is automatically granted to the first firm to admit to cartel involvement and provide information to strengthen the DOJ’s investigation, granted that the firm meets certain conditions. Amnesty is granted provided that (1) the DOJ does not already have an ongoing investigation into the cartel, (2) the corporation seeking amnesty took prompt action to terminate cartel activity, (3) the corporation fully complies with the DOJ and provides valuable information about the cartel, (4) the confession is a corporate act and not an isolated confession, (5) the corporation makes restitution where possible, and (6) the corporation was not the ringleader of the cartel. This Amnesty Policy was the result of concerns that current antitrust legislation was not having strong enough deterrent effects. The intent of the new legislation was to destabilize cartel activity by causing distrust in existing cartels and deterring cartels from forming in industries susceptible to such activity.Following the Department of Justice’s lead, the European Commission adopted similar legislation on February 19, 2002. The conditions for amnesty under the European Commission are similar to those of the Department of Justice, with the major difference being that the European Commission will grant amnesty to the ringleader of the cartel under certain conditions.Evaluating LeniencyEffective deterrent policy should have dual effect of (1) causing formidable distrust in existing cartels and (2) raising the expected losses from indictment to a level that exceeds expected profits. With regard to creating distrust in existing cartels, corporate leniency functions by offering huge incentives to the first--and only the first--firm to come forth with information regarding cartel activity. As long as the leniency seeker meets the necessary criteria, they avoid both fines and possible jail time, while the other firms incur massive damages. Firms participating in cartels are cooperating only because price-fixing enhances their individual profits, which suggests a lack of true loyalty between firms. In other words, this winner-takes-all approach should theoretically create a sufficient level of distrust among firms in existing cartels. Scott D. Hammond of the US Department of Justice notes in a 2001 press release that, “Over the last five years, the Amnesty Program has been responsible for detecting and prosecuting more antitrust violations than all of our search warrants, consensual-monitored audio or video tapes, and cooperating informants combined. It is, unquestionably, the single greatest investigative tool available to anti-cartel enforcers. Since we expanded our Amnesty Program in 1993, there has been more than a ten-fold increase in amnesty applications.” Furthermore, the cooperation of a leniency applicant has made the process of prosecuting cartels far more efficient. The problem with evaluating the effectiveness of the corporate leniency policy lies in only being able to draw inferences based on observed cartel activity (Zhou, 2). If undetected cartels function in a more sophisticated manner, the observed sample will be misrepresentative of cartel activity as a whole.Ultimately, the more important focus of antitrust enforcement should be preventing cartels from forming in the future. Consider a bank robber that stands to gain $50,000 from robbing a bank and risks $80,000 in fines if he is caught. If the robber anticipates only a 50% chance of being caught, then his expected losses are only $40,000 when weighed against the probability of getting caught. Thus expected profit exceeds expected losses, and committing the crime remains a rational strategy for him. Economic theory suggests that the same logic holds for firms considering collusion. In this light, research suggests that cartel sanctions are not at an optimal level. Research has shown that when weighing expected profits against expected losses for a sample of 75 cartels prosecuted in the Unites States, sanctions are only 9% to 21% as high as they should be to optimally prevent cartels from forming (Connor & Lande, 428). Fines from prosecution are calculated based on the estimated increase in revenue resulting from price-fixing, so if a cartel remains confident that they will go unnoticed, then expected profits will still exceed expected losses. That being said, the Department of Justice remains confident that the increase in both fines and jail time for convicted cartels and individuals over the past few decades is an indicator that antitrust policy is moving in the right direction (see figure 2 below). It remains unclear whether the increase in the number of cases being prosecuted corresponds to less cartel activity in general, or simply means cartel activity is much larger than previously imagined. The difficulty in discerning how many cartels continue to form despite deterrent policy leaves this question unanswered.

Leniency PolicyGovernment scrutiny of anticompetitive practices dates back to the passing of the Sherman Antitrust Act in 1890. Under the Sherman Antitrust Act, any contract or conspiracy in restraint of free trade was declared illegal, and those in violation of the act were subject to heavy fines or jail time. Public response to the act was mixed, with those in favor arguing that it protected consumer surplus by preventing monopolies from raising prices and thereby ensuring pure competition between firms. Those against argued that the act was in violation of the free market and ultimately failed in its intent to prevent unfair pricing by reducing economies of scale.On August 10, 1993, the United States Department of Justice (DOJ) adopted new legislation known as the Corporate Leniency Policy. Prior to this legislation, leniency (or partial leniency) was granted on a discretionary basis for firms that aided the DOJ in cartel investigations. Under the new guidelines, amnesty is automatically granted to the first firm to admit to cartel involvement and provide information to strengthen the DOJ’s investigation, granted that the firm meets certain conditions. Amnesty is granted provided that (1) the DOJ does not already have an ongoing investigation into the cartel, (2) the corporation seeking amnesty took prompt action to terminate cartel activity, (3) the corporation fully complies with the DOJ and provides valuable information about the cartel, (4) the confession is a corporate act and not an isolated confession, (5) the corporation makes restitution where possible, and (6) the corporation was not the ringleader of the cartel. This Amnesty Policy was the result of concerns that current antitrust legislation was not having strong enough deterrent effects. The intent of the new legislation was to destabilize cartel activity by causing distrust in existing cartels and deterring cartels from forming in industries susceptible to such activity.Following the Department of Justice’s lead, the European Commission adopted similar legislation on February 19, 2002. The conditions for amnesty under the European Commission are similar to those of the Department of Justice, with the major difference being that the European Commission will grant amnesty to the ringleader of the cartel under certain conditions.Evaluating LeniencyEffective deterrent policy should have dual effect of (1) causing formidable distrust in existing cartels and (2) raising the expected losses from indictment to a level that exceeds expected profits. With regard to creating distrust in existing cartels, corporate leniency functions by offering huge incentives to the first--and only the first--firm to come forth with information regarding cartel activity. As long as the leniency seeker meets the necessary criteria, they avoid both fines and possible jail time, while the other firms incur massive damages. Firms participating in cartels are cooperating only because price-fixing enhances their individual profits, which suggests a lack of true loyalty between firms. In other words, this winner-takes-all approach should theoretically create a sufficient level of distrust among firms in existing cartels. Scott D. Hammond of the US Department of Justice notes in a 2001 press release that, “Over the last five years, the Amnesty Program has been responsible for detecting and prosecuting more antitrust violations than all of our search warrants, consensual-monitored audio or video tapes, and cooperating informants combined. It is, unquestionably, the single greatest investigative tool available to anti-cartel enforcers. Since we expanded our Amnesty Program in 1993, there has been more than a ten-fold increase in amnesty applications.” Furthermore, the cooperation of a leniency applicant has made the process of prosecuting cartels far more efficient. The problem with evaluating the effectiveness of the corporate leniency policy lies in only being able to draw inferences based on observed cartel activity (Zhou, 2). If undetected cartels function in a more sophisticated manner, the observed sample will be misrepresentative of cartel activity as a whole.Ultimately, the more important focus of antitrust enforcement should be preventing cartels from forming in the future. Consider a bank robber that stands to gain $50,000 from robbing a bank and risks $80,000 in fines if he is caught. If the robber anticipates only a 50% chance of being caught, then his expected losses are only $40,000 when weighed against the probability of getting caught. Thus expected profit exceeds expected losses, and committing the crime remains a rational strategy for him. Economic theory suggests that the same logic holds for firms considering collusion. In this light, research suggests that cartel sanctions are not at an optimal level. Research has shown that when weighing expected profits against expected losses for a sample of 75 cartels prosecuted in the Unites States, sanctions are only 9% to 21% as high as they should be to optimally prevent cartels from forming (Connor & Lande, 428). Fines from prosecution are calculated based on the estimated increase in revenue resulting from price-fixing, so if a cartel remains confident that they will go unnoticed, then expected profits will still exceed expected losses. That being said, the Department of Justice remains confident that the increase in both fines and jail time for convicted cartels and individuals over the past few decades is an indicator that antitrust policy is moving in the right direction (see figure 2 below). It remains unclear whether the increase in the number of cases being prosecuted corresponds to less cartel activity in general, or simply means cartel activity is much larger than previously imagined. The difficulty in discerning how many cartels continue to form despite deterrent policy leaves this question unanswered. In conclusion, while corporate leniency has resulted in increased prosecution, fines, and jail time, it remains unclear as to whether sanctions are at a sufficiently optimal level to deter firms in industries susceptible to cartel activity from forming cartels. The worrying statistic is the amount of cartels that have continued to form in spite of the Corporate Leniency Policy, and the number of large corporations that have participated in multiple cartels over the last few decades. Cartel recidivism is a clear indicator that incentives still exist for firms to risk heavy fines and jail time by colluding. The Corporate Leniency Policy, while certainly a beneficial tool in creating instability in cartels and aiding in prosecution, is not a panacea to worldwide anti-competitive collusion.

In conclusion, while corporate leniency has resulted in increased prosecution, fines, and jail time, it remains unclear as to whether sanctions are at a sufficiently optimal level to deter firms in industries susceptible to cartel activity from forming cartels. The worrying statistic is the amount of cartels that have continued to form in spite of the Corporate Leniency Policy, and the number of large corporations that have participated in multiple cartels over the last few decades. Cartel recidivism is a clear indicator that incentives still exist for firms to risk heavy fines and jail time by colluding. The Corporate Leniency Policy, while certainly a beneficial tool in creating instability in cartels and aiding in prosecution, is not a panacea to worldwide anti-competitive collusion.

The (International) Optimal Bundle Spring Edition: Volume 13

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about Brazilian political instability. Other topics in this edition include French labor unions, the possible demise of the U.S. embargo on Cuba, and Chinese consumer confidence. This is an online version of the print edition of the Optimal Bundle.

The (Domestic) Optimal Bundle Spring Edition: Volume 12

Is College Really Worth It?

By Steve Leonard

Before reading on, it should be noted that I write this article from a neutral point of view. As I sit, I feel particularly jaded when it comes to college, as most seniors probably do. From these feelings come thoughts of the alternatives I could have picked four long years ago instead of going to college such as selecting a blue collar job like becoming an electrician. Out of curiosity I decided to make a few simple assumptions to determine if getting a degree is really more advantageous than working a blue collar job when it comes to retirement. We’ll pretend life begins at retirement then, and he who has the most saved at age 65 is the winner. We’ll need to make a few more assumptions to simplify this scenario enough to come to a conclusion.The first assumption will be that retirement contributions towards a 401k are 10% of salary. Salaries used will be $31,969 for a blue collar job, which is the average salary for an entry level electrician , and $45,327 for those with a bachelor’s degree, which is the average salary for a new college graduate. Savings work out to be $3,196 for a blue collar job and $4,532 for those with a bachelor’s degree. The second assumption will be that savings for retirement begin at age 18 for a blue collar job and at age 28 for those with a bachelor’s degree. While most people graduate at age 22, we’ll assume that savings won’t begin until age 28 to account for student loan debt. If graduates contribute $4,532 per year to a 401k and average student loan debt was $29,000 in 2012, we’ll assume those 6 years of would-be retirement savings are used to pay off debts instead. Third, we’ll assume the average retirement age is 65. The last assumption we’ll make is that the average rate of growth for a 401k is 5%.Under these assumptions, a blue collar worker who contributes $3,196 per year for 47 years earning 5% would have $569,269. Those with a bachelor’s degree contributing $4,532 per year for 37 years earning 5% would have $460,578. That’s a difference of $108,691. An electrician earns $108,691 more in retirement savings over their career than those who have earned a bachelor’s degree. In fact, someone with a bachelor’s degree would have to retire at age 68 if they wanted to have the same amount saved as an electrician who retired at age 65.I recognize that the assumptions made here simplify this complicated scenario to a great extent. I also recognize that those who attend college have higher lifetime earnings potential than those with blue collar jobs. However, there are many jobs that require degrees such as elementary education jobs where lifetime earnings are nearly on par with that of blue collar jobs.In the end, there is no right or wrong answer to whether college is worth it. Aside from a retirement standpoint, there are many other ways in which individuals gain value from going to college and there are many other ways in which individuals place value on not going to college. When it comes to retirement though, some blue collar jobs do in fact come out on top. And even for those blue collar jobs that may not come out on top, the retirement savings difference between college graduates and their counterparts may not be as large as some people imagine. For me, going to college was definitely a decision I’m glad I made, but I was certainly surprised to see how retirement savings can stack up against those who chose not to make the same decision I did.Sources:http://www.forbes.com/sites/kerryhannon/2013/01/13/the-three-surprises-in-401ks/#16b0c4c932eahttp://naceweb.org/salary-resources/starting-salaries.aspxhttp://ticas.org/sites/default/files/pub_files/Debt_Facts_and_Sources.pdfhttp://www.hamiltonproject.org/papers/major_decisions_what_graduates_earn_over_their_lifetimes/http://www.bls.gov/oes/current/oes472111.htm

The Frontier: Africa and the Irrationality of Equity Home Bias

By Joe Kearns

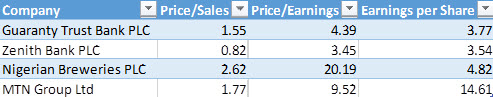

Africa has long been, and largely still is, avoided like the plague by investors from developed economies due to concerns over government corruption, war, and poor infrastructure. It shouldn’t be. Though declining commodity prices, China’s economic downturn, and policy failures have eroded investor confidence in Africa, the International Monetary Fund (IMF) projects the continent’s economic growth to reach 4% in 2016, a modest increase from 3.5% in 2015. In contrast, 2015 World GDP growth was -0.4% and U.S. GDP growth was 0.0%. The rational action for investors in developed economies searching for positive returns is to jump on a largely untapped opportunity to invest in Africa and go against the conventional bearish sentiment. The bedrock assumption of classical economics that individuals make rational choices is challenged by a concept in international finance called the equity home bias puzzle. Financial economist Kenneth French and public economist James Poterba wrote in “Investor Diversification and International Equity Markets” (1991) that individuals and institutions in most countries predominantly hold domestic equity and only a marginal amount of foreign equity. According to French and Poterba, at “the end of 1989, Japanese investors had only 1.9% of their equity in foreign stocks, while U.S. investors held 6.2% of their equity portfolio overseas.” In December 2014, David Snowball, publisher of the Mutual Fund Observer newsletter, estimated that just 0.3% of the average portfolio in the United States, or $3 of every $1000, is invested in African assets.It is true that many African investments have not fared well recently. Nigeria’s stock market index is down by 16% since the start of 2016. The S&P Zambia Index plunged 45% and its currency, the kwacha, depreciated by 45% relative to the dollar in one year. Ghana became mired in an economic crisis and had to pay a steep 10.75% interest rate for $1 billion in Eurobond. But even amidst unfavorable economic circumstances, the Ivory Coast stock exchange gained 7% in 2015 and the Kenyan stock exchange has been in the black since January. Both the Ivory Coast and Kenya are energy importers that benefit from the very phenomena which hurt economies like Angola, Nigeria, and Equatorial Guinea for whom 90% of export revenue is accounted for by oil.It hardly seems rational for investors—even risk-averse investors—to invest so little in such a promising opportunity. It is best not to look at Africa as a monolithic entity, but a variety of economies with their own unique investment opportunities that fare differently over time. There are several reasons to remain optimistic about the future of Africa and the recent dip in African stocks and currencies means now is an excellent time to join the party.Why Will African Economies Outperform the Developed World?Demographics suggest that Africa is attaining a labor market which is conducive to strong economic growth. Africa has the youngest population in the world with 200 million people aged between 15 and 24. According to the United Nations, this figure will double to 400 million people by 2045.It should be stressed that the economic situation is far from completely rosy in Africa. Six of the ten fastest growing economies in the world are in Sub-Saharan Africa, but the unemployment rate for the region is 6%. The African Development Bank (AfDB) reports that regional youth unemployment is twice as high as the general unemployment rate. North Africa especially suffers from high youth unemployment with a youth unemployment rate at 30%. Botswana, the Republic of the Congo, Senegal, and South Africa are among the countries which fare even worse than that region.Nevertheless, Marketwatch reporter Sara Sjolin conveyed a valid reason to believe the labor market will improve: “In the strongest African economies, as the workforce expands, economists expect demographics to drive higher demand for services, goods, housing and infrastructure, which in turn will help drive domestic economies.”To make this happen, African policymakers need to shift government spending towards facilitating growth in sectors like agriculture and manufacturing. Thomas Vester, manager of $875 million at the LGM Frontier Markets fund, credited Kenya, Ghana, Botswana, and Zambia as countries which have recently committed to longer-term projects like infrastructure and housing construction to support sectors with strong future growth. Vester forecasts that these economies will experience a 20-year trend of growth of about 6%-7% due to the fiscal stimulus. African policymakers have recognized that the optimal role of government is to intervene to facilitate economic growth and are slowly beginning to reap the rewards.Most importantly, data suggests that Africa is undergoing a transformative moment in its economic history. The natural resources and mining sectors have been the fastest-growing sectors for years in Africa, but Sjolin argues, “With rapid economic growth also comes a rising middle class that wants to go out, open bank accounts, buy branded groceries and, eventually, buy cars, houses and life insurance.” The biggest African economy, Nigeria, saw its middle class grow by 600% between 2000 and 2014. Sjolin also believes that by 2030 Ghana, Angola, and Sudan will experience a steep increase in middle-class families as well.The growth of a large middle class will be vital for African economic growth. Middle class consumers have a high marginal propensity to consume relative to their upper class counterparts, but also more disposable income than the poor. For this reason, the forecast of a substantially expanded middle class is the biggest reason to be optimistic about African economic growth.What Are The Best Investment Opportunities in Africa?The question for investors is who benefits from the consumption patterns of the new African middle class. Vester indicates that these middle-class consumers are likely to boost profitability for telecom companies, food and beverage companies, and banks. His fund has holdings in companies like the Guaranty Trust Bank in Nigeria and Senegalese telecom provider Sonatel. Meanwhile, Mark Mobius, executive chairman of Templeton Emerging Markets Group and manager of the Templeton Africa Fund, owns holdings Guaranty Trust Bank as well, along with Zenith Bank (Nigeria), Nigerian Breweries (Nigeria), and telecom firm MTN Group (South Africa).Vester and Mobius, however, entered into long positions with these firms at the end of 2014, prior to the volatility of 2015 and the asset market plunge in 2016. Consequently, the stock prices for companies have recently plummeted as shown below:Guaranty Trust Bank PLC

The bedrock assumption of classical economics that individuals make rational choices is challenged by a concept in international finance called the equity home bias puzzle. Financial economist Kenneth French and public economist James Poterba wrote in “Investor Diversification and International Equity Markets” (1991) that individuals and institutions in most countries predominantly hold domestic equity and only a marginal amount of foreign equity. According to French and Poterba, at “the end of 1989, Japanese investors had only 1.9% of their equity in foreign stocks, while U.S. investors held 6.2% of their equity portfolio overseas.” In December 2014, David Snowball, publisher of the Mutual Fund Observer newsletter, estimated that just 0.3% of the average portfolio in the United States, or $3 of every $1000, is invested in African assets.It is true that many African investments have not fared well recently. Nigeria’s stock market index is down by 16% since the start of 2016. The S&P Zambia Index plunged 45% and its currency, the kwacha, depreciated by 45% relative to the dollar in one year. Ghana became mired in an economic crisis and had to pay a steep 10.75% interest rate for $1 billion in Eurobond. But even amidst unfavorable economic circumstances, the Ivory Coast stock exchange gained 7% in 2015 and the Kenyan stock exchange has been in the black since January. Both the Ivory Coast and Kenya are energy importers that benefit from the very phenomena which hurt economies like Angola, Nigeria, and Equatorial Guinea for whom 90% of export revenue is accounted for by oil.It hardly seems rational for investors—even risk-averse investors—to invest so little in such a promising opportunity. It is best not to look at Africa as a monolithic entity, but a variety of economies with their own unique investment opportunities that fare differently over time. There are several reasons to remain optimistic about the future of Africa and the recent dip in African stocks and currencies means now is an excellent time to join the party.Why Will African Economies Outperform the Developed World?Demographics suggest that Africa is attaining a labor market which is conducive to strong economic growth. Africa has the youngest population in the world with 200 million people aged between 15 and 24. According to the United Nations, this figure will double to 400 million people by 2045.It should be stressed that the economic situation is far from completely rosy in Africa. Six of the ten fastest growing economies in the world are in Sub-Saharan Africa, but the unemployment rate for the region is 6%. The African Development Bank (AfDB) reports that regional youth unemployment is twice as high as the general unemployment rate. North Africa especially suffers from high youth unemployment with a youth unemployment rate at 30%. Botswana, the Republic of the Congo, Senegal, and South Africa are among the countries which fare even worse than that region.Nevertheless, Marketwatch reporter Sara Sjolin conveyed a valid reason to believe the labor market will improve: “In the strongest African economies, as the workforce expands, economists expect demographics to drive higher demand for services, goods, housing and infrastructure, which in turn will help drive domestic economies.”To make this happen, African policymakers need to shift government spending towards facilitating growth in sectors like agriculture and manufacturing. Thomas Vester, manager of $875 million at the LGM Frontier Markets fund, credited Kenya, Ghana, Botswana, and Zambia as countries which have recently committed to longer-term projects like infrastructure and housing construction to support sectors with strong future growth. Vester forecasts that these economies will experience a 20-year trend of growth of about 6%-7% due to the fiscal stimulus. African policymakers have recognized that the optimal role of government is to intervene to facilitate economic growth and are slowly beginning to reap the rewards.Most importantly, data suggests that Africa is undergoing a transformative moment in its economic history. The natural resources and mining sectors have been the fastest-growing sectors for years in Africa, but Sjolin argues, “With rapid economic growth also comes a rising middle class that wants to go out, open bank accounts, buy branded groceries and, eventually, buy cars, houses and life insurance.” The biggest African economy, Nigeria, saw its middle class grow by 600% between 2000 and 2014. Sjolin also believes that by 2030 Ghana, Angola, and Sudan will experience a steep increase in middle-class families as well.The growth of a large middle class will be vital for African economic growth. Middle class consumers have a high marginal propensity to consume relative to their upper class counterparts, but also more disposable income than the poor. For this reason, the forecast of a substantially expanded middle class is the biggest reason to be optimistic about African economic growth.What Are The Best Investment Opportunities in Africa?The question for investors is who benefits from the consumption patterns of the new African middle class. Vester indicates that these middle-class consumers are likely to boost profitability for telecom companies, food and beverage companies, and banks. His fund has holdings in companies like the Guaranty Trust Bank in Nigeria and Senegalese telecom provider Sonatel. Meanwhile, Mark Mobius, executive chairman of Templeton Emerging Markets Group and manager of the Templeton Africa Fund, owns holdings Guaranty Trust Bank as well, along with Zenith Bank (Nigeria), Nigerian Breweries (Nigeria), and telecom firm MTN Group (South Africa).Vester and Mobius, however, entered into long positions with these firms at the end of 2014, prior to the volatility of 2015 and the asset market plunge in 2016. Consequently, the stock prices for companies have recently plummeted as shown below:Guaranty Trust Bank PLC Zenith Bank PLC

Zenith Bank PLC Nigerian Breweries PLC

Nigerian Breweries PLC MTN Group PLC

MTN Group PLC These companies have seen sharp dips in their market value in the past year, but there are reasons to be confident in their fundamentals.

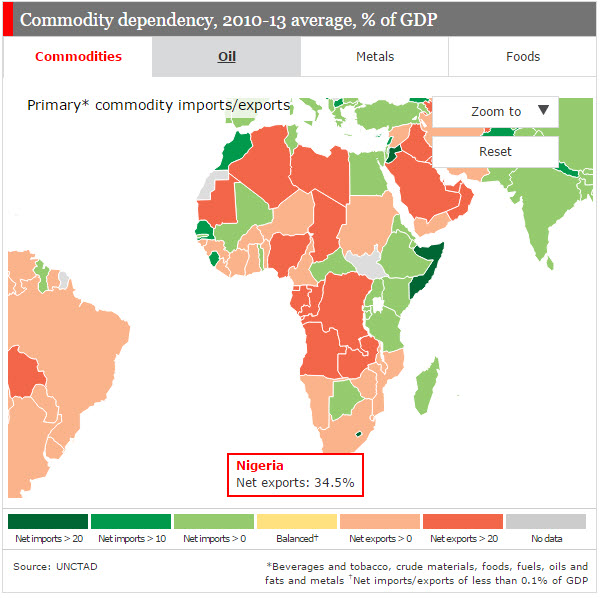

These companies have seen sharp dips in their market value in the past year, but there are reasons to be confident in their fundamentals. This small sample shows that it is reasonable to believe that there are long-term opportunities to invest in Africa and earn a high return. Though investors are afraid of the macroeconomic outlook in the short term, financial analysis of these companies indicates these fears are misdirected. The relatively high earnings per share, along with the relatively low price/sales and price/earnings (Nigerian Breweries PLC excepted for the P/E pattern), indicates that African companies can be solid bargains.With that being said, it is rational for short-term investors to have some anxiety. Like many frontier markets, African economies have struggled because of monetary policy divergence with the Federal Reserve Bank of the United States which has begun to raise its benchmark interest rate. More significantly, however, many African economies are dependent on exporting commodities like brent crude, foods, and metals. For instance, Nigeria’s net exports of commodities consist of 34.5% of its GDP.

This small sample shows that it is reasonable to believe that there are long-term opportunities to invest in Africa and earn a high return. Though investors are afraid of the macroeconomic outlook in the short term, financial analysis of these companies indicates these fears are misdirected. The relatively high earnings per share, along with the relatively low price/sales and price/earnings (Nigerian Breweries PLC excepted for the P/E pattern), indicates that African companies can be solid bargains.With that being said, it is rational for short-term investors to have some anxiety. Like many frontier markets, African economies have struggled because of monetary policy divergence with the Federal Reserve Bank of the United States which has begun to raise its benchmark interest rate. More significantly, however, many African economies are dependent on exporting commodities like brent crude, foods, and metals. For instance, Nigeria’s net exports of commodities consist of 34.5% of its GDP. For the time being, many African countries—especially the ones shaded in dark red on the graphic from The Economist shown above—are vulnerable to price swings of commodities like the drop in brent crude from $104.90 to its current level of $32.70. But given the fact that African governments have begun to diversify their economies, it is reasonable to believe that the woes of African stocks are transitory. If the map above looks much different in twenty years as I suspect, that means assets in Africa will have increased in value exponentially from where they are now. It is a risk to make that assumption, but I believe it is a well-calculated risk.The FutureThe long-term potential of African economic growth has created an excellent opportunity to exploit the risk aversion of other investors. There are short-term pains now, but it is best to follow the advice of Laura Garitz, manager of the U.S.-based Wasatch Frontier Emerging Small Countries fund. One quarter of her fund’s assets are invested in Africa and she has made no reductions this year. “Africa’s countries can no longer depend on a booming export market for resources to China,” Ms. Geritz said to The Wall Street Journal. “Africa will have to depend on its greatest asset—it’s pool of young, bright, driven people.”Moreover, the equity home bias puzzle demonstrates the validity of contributions from behavioral finance. There are not many fundamental reasons investors should allocate almost all of their assets in their home country, which creates an opportunity for risk-seeking investors willing to look elsewhere. Data indicates that Africa is clearly the best region for these investors to earn a high return. By continuing to miss out on the vast economic growth from the continent, developed market investors are leaving easy money on the table. Simply put, it pays to not always root for the home team.Author's Note: As always, this post reflects solely my own views, not those of the Penn State Economics Association or any other entity I represent.

For the time being, many African countries—especially the ones shaded in dark red on the graphic from The Economist shown above—are vulnerable to price swings of commodities like the drop in brent crude from $104.90 to its current level of $32.70. But given the fact that African governments have begun to diversify their economies, it is reasonable to believe that the woes of African stocks are transitory. If the map above looks much different in twenty years as I suspect, that means assets in Africa will have increased in value exponentially from where they are now. It is a risk to make that assumption, but I believe it is a well-calculated risk.The FutureThe long-term potential of African economic growth has created an excellent opportunity to exploit the risk aversion of other investors. There are short-term pains now, but it is best to follow the advice of Laura Garitz, manager of the U.S.-based Wasatch Frontier Emerging Small Countries fund. One quarter of her fund’s assets are invested in Africa and she has made no reductions this year. “Africa’s countries can no longer depend on a booming export market for resources to China,” Ms. Geritz said to The Wall Street Journal. “Africa will have to depend on its greatest asset—it’s pool of young, bright, driven people.”Moreover, the equity home bias puzzle demonstrates the validity of contributions from behavioral finance. There are not many fundamental reasons investors should allocate almost all of their assets in their home country, which creates an opportunity for risk-seeking investors willing to look elsewhere. Data indicates that Africa is clearly the best region for these investors to earn a high return. By continuing to miss out on the vast economic growth from the continent, developed market investors are leaving easy money on the table. Simply put, it pays to not always root for the home team.Author's Note: As always, this post reflects solely my own views, not those of the Penn State Economics Association or any other entity I represent.

The (Domestic) Optimal Bundle Spring Edition: Volume 10

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about U.S. Navy budget cuts. Other topics in this edition include President Obama's proposal to levy a tax on oil to fund public transportation and a decline in the U.S. government budget deficit.This is an online version of the print edition of the Optimal Bundle.

The (International) Optimal Bundle Spring Edition: Volume 11

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about the Make in India Initiative. Other topics in this edition include the role of toads in combating the Zika virus in Latin America, solar panels in France, and Chinese pollution.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Spring Edition: Volume 9

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about rocket mortgages. Other topics in this edition include yen depreciation and Argentina's debt restructuring proposal.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Spring Edition: Volume 8

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about populist sentiment against the Federal Reserve. Other topics in this edition include the economic impact of violence in Jerusalem and the global impact of Chinese economic volatility.This is an online version of the print edition of the Optimal Bundle.

Insider vs. Outsider: Should Wall Street Feel the Bern?

By Joe Kearns

It is no secret that former U.S. Secretary of State Hillary Clinton, like her husband Bill, has Wall Street’s ear. She has built personal relationships with prominent banking executives like Goldman Sachs CEO Lloyd Blankfein, Morgan Stanley CEO James Gorman, JPMorgan Chase CEO Jamie Dimon, and Bank of America Merrill Lynch CEO Brian Moynihan. This outreach to Wall Street executives and their employees is particularly useful to Clinton in fundraising for the 2016 presidential campaign. “The money is already behind her,” a Wall Street money manager told Politico. “I don’t think it’s starting to line up behind her: It’s there for her if she wants it.”Like her establishment Republican counterparts, Clinton faces an opposition characterized by distrust of political elites. This opposition in the Democratic presidential primary has virtually been personified in the form of U.S. Senator Bernie Sanders, a democratic socialist from Vermont who once honeymooned in the Soviet Union and had a softball team called the “People’s Republic of Burlington.” It is safe to say Sanders has not endeared himself to the capitalist crowd backing Clinton.Sanders does not rival Clinton’s endorsements or fundraising in this campaign, but he has become a thorn in her side with surprising success in generating support in early primary states. Recent polls indicate that Sanders and Clinton have a virtual tie in both Iowa and New Hampshire. Clinton has a huge lead in the next primaries (South Carolina and Nevada), but it is worth watching if news from the early primaries produces a feedback loop which trims her advantage.A major reason for Sanders’s unlikely ascendance is the attractiveness of his anti-Wall Street populism to progressive voters in the Democratic Party. The concise diction (“Break up the banks”) of his proposals is catchy and easily understandable at a superficial level, in contrast to wonkiness of Clinton’s proposals. Financial markets, however, are complex and the question of which candidate’s regulatory policies have more social benefit requires a nuanced analysis.Glass-Steagall: Should It Be Resurrected? The Glass-Steagall Act was originally enacted in 1933 and it prohibited commercial banks from participating in the investment banking business. This was the case until the act was essentially repealed in 1999 under President Bill Clinton.Sanders has argued that the repeal of Glass-Steagall allowed investment banks to speculate with depositors’ money held in commercial banks, and, consequently, paved way for banks to merge with one another at a rapid pace to create institutions that were too big to fail. “Let’s not forget: President Franklin Roosevelt signed this bill into law precisely to prevent Wall Street speculators from causing another Great Depression,” Sanders said in a speech, according to boston.com. “And it worked for more than five decades, until Wall Street watered it down under President Reagan and killed it under President Clinton.”Clinton, like her husband, refutes the idea that Glass-Steagall triggered the financial crisis, pointing to the fact that the law would not have applied to any of the institutions at the heart of the crisis. New York Times columnist Andrew Ross Sorkin adds credence to Clinton’s argument by noting the irrelevance of Glass-Steagall to these institutions. For instance, Bear Stearns, Lehman Brothers, and Merrill Lynch were investment banks with no commercial banking business. For commercial banks like Bank of America and Wachovia, the problems stemmed from acquisitions of lenders Countrywide Financial and Golden West respectively. Other entities are not banks at all, and would not be regulated under Glass-Steagall: American International Group is an insurance company, while Fannie Mae and Freddie Mac are government-sponsored enterprises. When asked whether the financial crisis or JPMorgan Chase’s crisis-era $2 billion trading loss would have prevented by Glass-Steagall, U.S. Senator Elizabeth Warren (a leading proponent of restoring the act) conceded to Sorkin, “The answer is probably ‘No’ to both.”In fact, Bill Clinton argued that the rollback of Glass-Steagall made it easier for institutions to recover from the 2008 financial crisis, citing the acquisition of Merrill Lynch by Bank of America. In this context, it is difficult to prove that the rollback of Glass-Steagall has had adverse economic effects and there is some evidence was beneficial. There is a role for regulation of merged investment and commercial banks, but this should not inhibit the positive attributes of larger firms. While Glass-Steagall is an effective boogeyman for Sanders, it appears to be little more than that.Is Bigness Really Bad?

The Glass-Steagall Act was originally enacted in 1933 and it prohibited commercial banks from participating in the investment banking business. This was the case until the act was essentially repealed in 1999 under President Bill Clinton.Sanders has argued that the repeal of Glass-Steagall allowed investment banks to speculate with depositors’ money held in commercial banks, and, consequently, paved way for banks to merge with one another at a rapid pace to create institutions that were too big to fail. “Let’s not forget: President Franklin Roosevelt signed this bill into law precisely to prevent Wall Street speculators from causing another Great Depression,” Sanders said in a speech, according to boston.com. “And it worked for more than five decades, until Wall Street watered it down under President Reagan and killed it under President Clinton.”Clinton, like her husband, refutes the idea that Glass-Steagall triggered the financial crisis, pointing to the fact that the law would not have applied to any of the institutions at the heart of the crisis. New York Times columnist Andrew Ross Sorkin adds credence to Clinton’s argument by noting the irrelevance of Glass-Steagall to these institutions. For instance, Bear Stearns, Lehman Brothers, and Merrill Lynch were investment banks with no commercial banking business. For commercial banks like Bank of America and Wachovia, the problems stemmed from acquisitions of lenders Countrywide Financial and Golden West respectively. Other entities are not banks at all, and would not be regulated under Glass-Steagall: American International Group is an insurance company, while Fannie Mae and Freddie Mac are government-sponsored enterprises. When asked whether the financial crisis or JPMorgan Chase’s crisis-era $2 billion trading loss would have prevented by Glass-Steagall, U.S. Senator Elizabeth Warren (a leading proponent of restoring the act) conceded to Sorkin, “The answer is probably ‘No’ to both.”In fact, Bill Clinton argued that the rollback of Glass-Steagall made it easier for institutions to recover from the 2008 financial crisis, citing the acquisition of Merrill Lynch by Bank of America. In this context, it is difficult to prove that the rollback of Glass-Steagall has had adverse economic effects and there is some evidence was beneficial. There is a role for regulation of merged investment and commercial banks, but this should not inhibit the positive attributes of larger firms. While Glass-Steagall is an effective boogeyman for Sanders, it appears to be little more than that.Is Bigness Really Bad? Sanders’ campaign taps into an American political legacy of distrust in capitalistic institutions which consists of Andrew Jackson’s demonization of the Second Bank of the United States as the “monster bank,” William Jennings Bryan’s “Cross of Gold” speech, and Theodore Roosevelt’s trust-busting campaign. The prospect of undermining the power of elite institutions especially resonates with the public in the aftermath of the 2007-08 financial crisis.POLITICO senior staff writer Michael Grunwald complicates the uplifting populist narrative underlying Sanders’ financial reform proposals by arguing that the size of the largest U.S. financial institutions is not merely a necessary evil in a capitalist economy, but a positive good: “If JP Morgan hadn’t been big and strong enough to absorb the hemorrhaging balance sheets of Bear Stearns and Washington Mutual, we might well have endured a depression. Ditto if Wells Fargo hadn’t been big and strong enough to let Wachovia collapse in its arms. The world is also lucky Bank of America was big and (arguably) dumb enough to salvage Countrywide and Merrill Lynch from the jaws of death.”Sanders’ fear of institutions becoming “too-big-to-fail” is rational to an extent given the interdependence between banks, but he is wrong to believe simply reducing the size of banks eradicates risk. His solution in the “Too Big To Fail, Too Big To Exist Act” even exacerbates risk by creating enormous uncertainty in financial markets: “the Financial Stability Oversight Council shall compile and submit to the Secretary of the Treasury a list of entities that it deems Too Big To Fail, which shall include, but is not limited to, any United States bank holding companies that have been identified as systemically important banks by the Financial Stability Board…the Secretary of the Treasury shall break up entities included on the Too Big To Fail List, so that their failure would no longer cause a catastrophic effect on the United States or global economy without a taxpayer bailout.”The act lacks any definition or guidelines on what constitutes an institution that is “Too Big To Fail” or what procedure is to be used to break it up. Moreover, the risk-averse nature of investors suggests that the natural result of this act’s vagueness will be lower lending to all individuals including those who are low-income and, consequently, lower economic growth. In essence, Sanders’ solution is worse than the problem.What is Clintonian Capitalism?

Sanders’ campaign taps into an American political legacy of distrust in capitalistic institutions which consists of Andrew Jackson’s demonization of the Second Bank of the United States as the “monster bank,” William Jennings Bryan’s “Cross of Gold” speech, and Theodore Roosevelt’s trust-busting campaign. The prospect of undermining the power of elite institutions especially resonates with the public in the aftermath of the 2007-08 financial crisis.POLITICO senior staff writer Michael Grunwald complicates the uplifting populist narrative underlying Sanders’ financial reform proposals by arguing that the size of the largest U.S. financial institutions is not merely a necessary evil in a capitalist economy, but a positive good: “If JP Morgan hadn’t been big and strong enough to absorb the hemorrhaging balance sheets of Bear Stearns and Washington Mutual, we might well have endured a depression. Ditto if Wells Fargo hadn’t been big and strong enough to let Wachovia collapse in its arms. The world is also lucky Bank of America was big and (arguably) dumb enough to salvage Countrywide and Merrill Lynch from the jaws of death.”Sanders’ fear of institutions becoming “too-big-to-fail” is rational to an extent given the interdependence between banks, but he is wrong to believe simply reducing the size of banks eradicates risk. His solution in the “Too Big To Fail, Too Big To Exist Act” even exacerbates risk by creating enormous uncertainty in financial markets: “the Financial Stability Oversight Council shall compile and submit to the Secretary of the Treasury a list of entities that it deems Too Big To Fail, which shall include, but is not limited to, any United States bank holding companies that have been identified as systemically important banks by the Financial Stability Board…the Secretary of the Treasury shall break up entities included on the Too Big To Fail List, so that their failure would no longer cause a catastrophic effect on the United States or global economy without a taxpayer bailout.”The act lacks any definition or guidelines on what constitutes an institution that is “Too Big To Fail” or what procedure is to be used to break it up. Moreover, the risk-averse nature of investors suggests that the natural result of this act’s vagueness will be lower lending to all individuals including those who are low-income and, consequently, lower economic growth. In essence, Sanders’ solution is worse than the problem.What is Clintonian Capitalism?

Aware of the need to counter Sanders’ populist message, Clinton wrote an op-ed which awkwardly attempts to reconcile leftist sentiment with an array of piecemeal reforms which enhance, rather than undermine, free-market capitalism. In one vein, she copies Sanders’ message by arguing, “I would also ensure that the federal government has—and is prepared to use—the authority and tools necessary to reorganize, downsize and ultimately break up any financial institution that is too large and risky to be managed effectively.” Like Sanders, she does not clarify what kind of tools she would use to orchestrate such a breakup.On the other hand, there is a less ambitious, but more useful theme underlying Clinton’s reforms: to level the playing field and equalize information for financial markets. Her proposal to increase leverage and liquidity requirements for broker-dealers and impose strict margin requirements for short-term borrowing might be onerous, but, if comprehensibly constructed, it would equalize the oversight of the traditionally less-regulated shadow banking system and its more heavily-regulated commercial banking counterpart. This is laudable, as the financial crisis was partly a product of the disproportionately low regulation of hedge funds, investment banks, government-sponsored enterprises, and other non-banking financial institutions which make up the shadow banking system.Moreover, Clinton’s proposal to independently fund the Securities and Exchange Commission and Commodity Futures Trading Commission would provide more stability and consistency in the enforcement of financial regulations. Her suggestion of a tax on high-frequency trading not only fulfills this goal, but it reduces the ability of some investors to exploit others who lack their quality of information to make an optimal decision. The virtue of these reforms come from the positive externality of lower uncertainty for investors which leads to a bigger societal risk appetite sufficient for economic growth. Clinton’s proposal has flaws, namely its absence of adequate details regarding the size and scope of future regulation, but its promise lies in an understanding of the nuances of financial markets that Sanders lacks.The VerdictSanders suggests that the nature of capitalism is inherently flawed and requires a drastic upheaval of large financial institutions. Clinton’s reforms instead are largely designed to tweak the framework of financial markets to more optimally utilize the capabilities of capitalism. I have concluded that Clinton’s plan is more conducive to economic growth, a stronger risk appetite, and even the goal of reducing wealth inequality championed by Sanders. Yet, I credit Sanders for pushing financial reform to the forefront of this presidential election campaign and pressuring Clinton to respond to his ideas. Ironically, the democratic socialist senator has demonstrated the virtues of a competitive marketplace of ideas with his presence in the Democratic primary.Author's Note: As always, the content of this post solely reflects the views of the author, not the Penn State Economics Association.

The Abominable Bundle

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This Christmas edition of the Optimal Bundle features an op-ed about holiday shopping. Other topics in this edition include efficient gift giving, the UN climate change summit, and the ECB's stimulus program.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Fall Edition: Volume 7

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about slash-and-burn practices in Indonesia and their role in emitting carbon. Other topics in this edition include PlayStation 4's ability to elude government surveillance, the G-20's discussion on financial stability measures, and the implications of the terrorist attacks in Paris last week.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Fall Edition: Volume 6

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about San Francisco's Regulations of Airbnb. Other topics in this edition include the Keystone XL Pipeline, the Catalonian Secession Vote, and Britain's Possible Withdrawal from the European Union.This is an online version of the print edition of the Optimal Bundle.

Urban Migration in the 21st Century

We’ve all experienced the inevitable logjam that results from entering the city, whether it’s New York or Los Angeles. We’ve pulled off the freeway, slowed to a crawl in the exit lane, and sat back for a long wait, as the traffic bottlenecks. And the closer we are to the stunning skyscrapers and bustling boulevards, the denser the logjam. Rush hour never ends in the city. But why? Why do hundreds of thousands of people pour in to these areas every day? And what does it mean for today’s world?Although several factors push people to move to cities, an overarching theme among them is the desire for a modern way of life. Workers come in search of employment opportunities in burgeoning sectors like services and technology that are less abundant in small towns and rural areas. Cities also tend to be more politically and socially progressive, due to greater accountability and cultural diversity. New York, for example, is a leader in “open data,” an urban policy that grants citizens access to a trove of information about the day-to-day operations of public services and government programs within the city. People – certainly young adults, who embody those flocking to the city – are attracted to this dynamism.According to the United Nations, approximately 4 billion people, or 54 percent of the global population, now live in urban areas. This number is projected to rise to nearly two-thirds of the global population by 2050, with most of the growth occurring in developing countries. Of the 4 billion today, 1 in 8 live in so-called “mega-cities” of over 10 million inhabitants, such as Tokyo, Delhi, Shanghai, and Mexico City. The world is urbanizing faster than ever before.As demographic power shifts towards cities, economic power is moving in the same direction. Cities account for over 80 percent of world GDP and are central to economic development. Not only do they benefit from large pools of consumers and talent, but they concentrate government, financial capital, and transportation and utilities infrastructure. This concentration helps to lower transaction costs and create networks conducive to innovation. The enhanced productivity of cities can drive growth and raise a country’s standards of living, including life in rural areas. They are also associated with lower fertility, a crucial aspect of the transition from “developing” to “developed.”However, not all cities are equally effective, nor are all inhabitants within a city equally well-off. On the contrary, cities are often known for stark income inequality. For every high-rise, there may be ten who are homeless or barely sheltered on the fringe; for every limousine and luxury boutique, there may be twenty who are struggling to pay bills on minimum-wage jobs. Indeed, cities often have vast informal economies in which workers earn much less than the minimum wage and cannot expect any stable income. These workers, especially women, are highly vulnerable to poverty traps. The disparity between the very wealthy and the extremely poor in cities is nowhere as apparent as in the slums, or informal settlements of the indigent. Here, crowding, unsanitary conditions, crime, and lack of access to utilities, healthcare, and education prevail. As population density increases, it becomes harder and harder to scale and share these resources among more people.The challenges to sustainability explain why megacities, despite their rapid rise and distinct advantages for economic growth, are not considered the ideal destinations for those seeking to relocate. Every year, the Economist Intelligence Unit ranks cities around the world by “liveability,” or a combination of their stability (safety), healthcare, education, infrastructure, and environment. At the top of the list are “mid-sized cities in wealthier countries with a relatively low population density,” rather than seemingly obvious world-class candidate cities like London.Fortunately, deliberate urban planning can bring cities of all sizes closer to their economic and social potential. The World Bank, one of many institutions to take on research in urban planning, is developing strategies focused on building affordable housing and climate-friendly infrastructure. The ability of governments to address these priorities and implement solutions will shape the future of cities – and in our increasingly urban world, our future as well.This blog post was written by Eleanor Tsai.Sourceshttp://www.economist.com/blogs/graphicdetail/2015/08/daily-chart-5http://www.ted.com/topics/citieshttp://www.theatlantic.com/business/archive/2012/05/what-is-the-worlds-most-economically-powerful-city/256841/http://www.worldbank.org/en/topic/urbandevelopment/overviewhttp://www.mckinsey.com/insights/urbanization/urban_worldhttp://esa.un.org/unpd/wup/Highlights/WUP2014-Highlights.pdf

The Optimal Bundle Fall Edition: Volume 5

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about the legal status of FanDuel and DraftKings. Other topics in this edition include a housing bubble in London, military conflicts in Syria and Afghanistan, and Japan Post's IPO.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Fall Edition: Volume 4

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about the Peoples' Bank of China's decision to cut interest rates. Other topics in this edition include the Italian government's budget reforms, mortgage lending regulations, and the effect of low oil prices on Middle Eastern governments' budgets.This is an online version of the print edition of the Optimal Bundle.

The Optimal Bundle Fall Edition: Volume 3

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about how financial markets are affecting emerging market economies. Other topics in this edition include the Trans-Pacific Partnership, the UN and World Bank's response to humanitarian crises in the Middle East and North Africa, and a debate on which unemployment rate is most indicative of economic health.This is an online version of the print edition of the Optimal Bundle.

The Economics of Movie Sequels

Sometimes, it seems like movie studios would rather produce sequels than original material. Often, some sequels feel like an afterthought, unlike the planned sequels to the original Star Wars or Lord of the Rings movies. Taken, which has had two subsequent movies released since the original, was surely not meant to have sequels, right? Why would movie studios rather piggyback their previous work instead of making something that’s creatively original? Of course, the obvious answer is that there’s money to be made, but two not-so-obvious trends show us why.

First, the number of weekly movie-goers is shrinking, down from about 80% of households in the 1940s to about 5% of households now. As a result, movie studios have begun catering towards audiences they’ve already captured with an original movie. This is a successful strategy because people are much more likely to return to the box office to view characters and environments they’re already familiar with. In 2011, one fifth of all movie releases were some sort of sequel, prequel, or movie otherwise based off of an original. Likewise, last year, 18 of the top 25 films by box office revenue in North America fell into the same category. While a decreasing box office audience can’t be linked directly to an increase in sequels, it certainly creates a compelling argument for why studios have shifted their focus over time.The second trend, which was revealed by Edward J. Epstein’s The Hollywood Economist, shows that movie revenues have shifted away from the box-office, which now accounts for only 20% of total movie revenues. Instead, revenues are coming from things like DVDs and streaming services, which make up 80% of total movie revenues. Because of this, the possibility of a movie becoming a hit through ticket sales, merchandise, and licensing is decreasing, which also means that the opportunity cost of investing substantial amounts of money into an original movie is increasing. The result is that studios are investing in sequels where the success of a story and its merchandise and licensing is already established. This allows them to minimize the risk associated with the creation of a new movie. In fact, in 2011 The Wall Street Journal estimated that Disney would allocate 80% of its budget towards franchise films, up from 40% a year before. This substantial budget allocation is a testament to the money-making power that sequels hold, and these trends give no surprises as to why we see so many.It’s interesting to note that the idea of piggybacking the success of a previous title also applies to the video game industry, where sequels are perhaps more prevalent than in the movie industry. Some of the most popular gaming titles are long running franchises, like Assassin’s Creed, Grand Theft Auto, Far Cry, and Call of Duty. And the idea of returning to these concepts works, as evidenced by Grand Theft Auto V’s record breaking release. It broke 6 Guinness World Records including best-selling video game in 24 hours, fastest selling entertainment property to gross $1 Billion, and highest grossing video game in 24 hours. Even the Call of Duty series, which is 10 titles deep, continues to see an upward trend in sales for each new title. Few movie series in the long history of cinema have pulled this off, and the ones that do are able to do so in a clever way. The James Bond franchise has seen 24 releases; however, the series can reinvent itself with every new Bond face, which allows it to stave-off franchise fatigue. Likewise, The Avengers is another title that has been extremely successful. Although the series has seen 13 releases, nearly every movie is different from its predecessor because they all follow the life and times of different superheroes, which allows the franchise to feel fresh and unique with every new release.It should be interesting to watch how the movie industry is shaped moving forward, especially by websites that allow people to watch movies for free on the internet. It’s become easier than ever to watch movies online, and even new releases aren’t safe. For example, I found The Martian on the internet not two weeks after its release to theaters. The amount of revenue that these websites deny movie franchises is likely no small amount either. And despite the efforts of law enforcement, movie studios, and movie cinemas to curb this illegal activity, it’s hard to say that they will be able to remove this illegal streaming activity all together. As a result, the success of new and original movies will likely become increasingly rare. If this is true, and current trends continue, perhaps sequels will be the only things that are released in the future. Although I must say, I'm really looking forward to seeing Star Wars: Episode XLIV.This post was written by Steve Leonard.Sources:http://www.moviescopemag.com/market-news/featured-editorial/economics-hollywood-sequels/http://www.theatlantic.com/business/archive/2013/07/the-6-graphs-you-need-to-see-to-understand-the-economics-of-awful-blockbuster-movies/277691/http://www.guinnessworldrecords.com/news/2013/10/confirmed-grand-theft-auto-breaks-six-sales-world-records-51900/http://www.statisticbrain.com/call-of-duty-franchise-game-sales-statistics/http://www.gamesradar.com/30-longest-running-movie-franchises/

The Optimal Bundle Fall Edition: Volume 2

The Optimal Bundle is a student publication run by the Penn State Economics Association’s Print Education Subcommittee.This edition of the Optimal Bundle features an op-ed about whether the U.S. Congress should ratify the Trans-Pacific Partnership. Other topics in this edition include the Federal Reserve's decision to not raise rates, General Motors's settlement regarding ignition switch defects, and Volkswagen's production of 11 million cars which violate EPA clean energy standards.This is an online version of the print edition of the Optimal Bundle.